Contribution to climate change mitigation

Management approach

Samruk-Energy JSC supports the goals of the Paris Agreement aimed at reducing greenhouse gas emissions in the context of sustainable development and improving the quality of life of the population. The Company endeavours to contribute to the goal of limiting the increase in the average temperature of the planet to well below 2 °C above pre-industrial levels. This requires a major transformation of the energy system, which is an important task for society as a whole. Both government, business, investors and consumers play an important role in this process.

Samruk-Energy JSC strives to provide access to reliable, affordable and environmentally friendly energy for as many people as possible. In this context, the Company is focused on achieving carbon neutrality by 2060. As part of this goal, Samruk-Energy actively implements innovative and sustainable technologies aimed at improving energy efficiency, decarbonisation and reducing carbon footprint.

In its activities, the company focuses on implementing initiatives to reduce greenhouse gas emissions, improving energy efficiency and introducing modern environmentally friendly technologies. Samruk-Energy is actively working to improve its energy infrastructure, integrate renewable energy sources and develop sustainable solutions for sustainable energy supply that contribute to environmental safety and economic growth of the country.

Climate change mitigation management model

The corporate governance system of Samruk-Energy JSC is focused on achieving sustainable success, as it is aimed at creating long-term value for shareholders, realising the importance of environmental and social aspects of the Company's activities and, as a consequence, the need to take into account the interests of all stakeholders.

Samruk-Energy JSC attaches paramount importance to climate risk management, providing a reliable basis for achieving strategic goals. Voluntarily assuming obligations to reduce greenhouse gas emissions, the Company actively implements decarbonisation measures.

Board of Directors

The Chairman of the Board has direct responsibility for the strategic direction of sustainable development, including reducing our carbon footprint. The Board sets both short-term and long-term climate targets.

In addition, the Board of Directors is the first level in the process of overseeing the corporate risk management system, which includes climate risks defined as the company's strategic risks.

The Board of Directors shall approve annually:

- Levels of responsibility for monitoring and controlling risks;

- Register and Risk Map, including climate risks;

- Key Risk Indicators (KRIs);

- Action plan for key risk management.

The Board also approves the company's risk appetite at a consolidated level and risk reports are provided to the Audit Committee on a quarterly basis.

The Board of Directors periodically undergoes training on the climate agenda. In 2024, on 28 November, the Risk Management and Internal Control Department with the involvement of a training organisation held a corporate seminar on the topic “Climate Risks for Energy Sector Enterprises”.

On 10 December 2024, the training organisation held a training seminar with the involvement of international experts for the members of the Board of Directors, top management and executives of the Company on the topic: “Climate Change and Energy Development Prospects”.

Role of the Executive Body

The day-to-day operations of the Company are managed by the Management Board, which interacts with the Board of Directors and stakeholders. The Chairman of the Management Board, as a member of the Board of Directors, is responsible for the implementation of strategic goals, including climate policy.

The responsibilities of the Chairman of the Management Board in the area of climate include:

- Coordination of budgets for carbon footprint reduction activities;

- Leading capital and operational investment in low carbon technologies;

- Oversee climate-sensitive acquisitions, mergers and divestitures.

Climate issues are considered when reviewing the company's strategy and plans.

Specialised committees and working groups

The Company has a specialised committee overseen by the Board of Directors to consider health, safety and environmental issues in depth. It develops recommendations on policies and procedures related to sustainable development and climate policy.

In addition, there is a working group on energy transition, which brings together employees from various divisions to comprehensively manage this process. The working group is headed by the Chairman of the Management Board.

Climate change and long-term scenarios

Samruk-Energy JSC develops short-, medium- and longterm scenarios of macroeconomic, financial, energy and climate conditions to support planning, capital allocation, strategic positioning, and strategy sustainability and risk assessment.

To analyse scenarios and the external context, the Company identifies and studies short-, mediumand long-term trends, forming an overall view of how structural factors and current macroeconomic trends affect the pace of the energy transition and the expected consequences for the energy sector, in particular for the business areas in which the Company operates.

Samruk-Energy JSC Energy Transition Programme until 2060

Samruk-Energy JSC aims to achieve carbon neutrality by 2060. To implement this goal, the Samruk-Energy JSC Energy Transition Programme until 2060 was developed, which defines strategic directions, goals and objectives for the introduction of resource-saving and environmentally friendly technologies. The programme covers the entire Group of companies and includes medium-term (until 2030) and long-term (until 2060) plans, taking into account socio-economic and climate risks.

To assess the risks and opportunities associated with the energy transition, alternative scenarios to the baseline scenario have been identified, depending on the level of climate ambition at global and local levels:

- Business as usual – A baseline scenario assuming no significant technological changes or policy measures aimed at achieving carbon neutrality. This scenario serves as a benchmark for comparison with the results of other scenarios. It envisages further development of all types of generation (RES, alternative energy, conventional generation) and extrapolation of historical trends observed in Kazakhstan into the future. The scenario has been modelled under STEP (The Stated Policies Scenario) conditions, which allows to assess possible trajectories of the energy sector development under the conditions of maintaining existing and planned policy measures without introducing additional solutions. The model does not assume that governments and companies will achieve all of their stated objectives.

- Decarbonisation scenario assumes a moderate reduction in greenhouse gas emissions. It is based on APS (The Announced Pledges Scenario) modelling conditions, which reflect possible ways of developing the energy system using advanced technologies. This allows the Company to assess the maximum potential effect of the country's current climate commitments and to determine how ambitious these commitments are and whether they can contribute to the achievement of global climate goals within the Company's operations. This scenario helps to identify areas where climate action needs to be strengthened to achieve more ambitious targets.

- Deep decarbonisation (ambitious) scenario assumes a significant increase in the share of RES (renewable energy sources) in the company through prospective and future projects, as well as the application of existing low-carbon technologies. This scenario is in line with the key principles of the NZE50 (Net Zero Emissions) model. Under NZE, countries are assumed to achieve zero carbon emissions by 2050. The deep decarbonisation scenario takes into account the weaknesses of the more moderate scenario and significantly increases ambitions to decommission conventional power units as well as to expand renewable energy capacity. Emission trajectories in the deep decarbonisation scenario correspond to a 50% probability of limiting global warming to 1.5°C, without exceeding the critical temperature threshold.

Decarbonisation scenario (unconditional)

| Name | 2030 | 2040 | 2050 | 2060 |

|---|---|---|---|---|

| SE market share | 64% | 63% | 55% | 47% |

| Share of clean energy | 33% | 30% | 34% | 37% |

| Share of traditional generation (coal, gas) | 67% | 70% | 66% | 63% |

| Net RS | +33% | -22% | -87% | -100% |

Deep decarbonisation scenario (conditional)

| Name | 2030 | 2040 | 2050 | 2060 |

|---|---|---|---|---|

| SE market share | 64% | 65% | 56% | 48% |

| Share of clean energy | 33% | 32% | 40% | 46% |

| Share of traditional generation (coal, gas) | 67% | 68% | 60% | 54% |

| Net RS | +33% | -30% | -100% | -100% |

The Business as usual scenario is used as a comparison model and is not a target scenario. Carbon neutrality is not achieved in this scenario. The Decarbonisation scenario represents an unconditional target model and optimal development pathway, while the Deep Decarbonisation scenario can be implemented under favourable conditions.

As part of the analysis of the Programme development scenarios, the Company has identified significant climatic physical as well as climatic transition risks (environmental risks are not considered within the Programme).

Climate risks and their impact on the energy sector

| Energy category | Risks | Consequences | Minimisation measures |

|---|---|---|---|

| Physical risks | |||

| Wind power | Low wind speed. | Instability of power generation, reduction of system efficiency. | Infrastructure modernisation, monitoring and adaptation to changes in wind conditions. |

| Solar energy | Cloudiness and precipitation. | Decrease in solar panel capacity, unstable power generation. | Development of technologies to improve efficiency under cloudy and precipitation conditions. |

| Hydropower | Uneven precipitation, temperature and wind fluctuations. | Instability in power generation, possible fluctuations in water resources. | Development of water management systems, creation of reserve reservoirs and dams. |

| Traditional energy (TPP) | Extreme temperatures. | Increased risks of accidents, increased costs for equipment and system maintenance. | Strengthening the structural stability of the equipment, modernisation for operation in extreme temperatures. |

| Energy infrastructure | Precipitation and extreme weather events. | Increase in the risk of accidents, decrease in the overall efficiency of energy systems. | Creation of backup energy sources, improvement of resistance to extreme weather conditions, modernisation of equipment. |

| Climate Transition Risks | |||

| Political and legal risks | Tougher international and national climate change policies, implementation of a crossborder carbon tax (CBT), stricter environmental legislation, carbon pricing. | Increased costs of complying with new standards, possible fines and penalties, and the need for changes in business models. | Adaptation of the company to new requirements, active participation in shaping climate policy, compliance with environmental norms. |

| Reputational risks | Stakeholder perceptions of the company’s involvement in the transition to a low-carbon economy. | Loss of confidence on the part of consumers, investors and other stakeholders, reduction of competitiveness. | Transparency in operations, public reporting on climate strategy, participation in environmentally sustainable initiatives. |

| Investment risks | Untimely or poor execution of investment projects, high cost, lack of financing, technological difficulties and tariff issues. | Project delays, budget overruns, technological failures, increased financial risks. | Attracting strategic investors, careful planning and evaluation of investment projects, risk management. |

| Technological, social and economic risks of the energy transition | |||

| Technological risks | Accelerating the transition to a low-carbon economy and the need for continuous monitoring and deployment of new technologies. | Delays in the transition process, insufficient adaptation to new technologies, reduced competitiveness. | Investing in research and development, implementation of innovative solutions, monitoring and implementation of new technologies. |

| Social risks | Job cuts in traditional industries and the need to retrain staff. | Increased social tension, employee dissatisfaction, shortage of qualified personnel. | Development of retraining programmes, transition support for employees, creation of new jobs in green sectors. |

| Economic risks | Threat to energy security, growth of electricity consumption, limited energy resources, currency risks associated with financing projects in foreign currency. | Higher energy costs, resource scarcity, financial risks due to currency fluctuations. | Diversification of energy sources, attraction of strategic investors, monitoring of currency risks and stability of financing. |

The scenarios and assumptions presented below have formed the basis of this assessment of potential impacts:

| Scenarios | Key assumptions |

|---|---|

| NDC – Soft |

|

| NDC – Hard |

|

| Net Zero – Soft |

|

| Net Zero – Hard |

|

Based on the results of our analysis of the potential impact of transient climate risks on our operations, the following results were highlighted:

- Samruk-Energy JSC is resilient to NDC Soft and Net Zero Soft scenarios. In the first case, the level of exposure is limited, while in the second case the transition prerequisites provide compensating levers for the burden associated with transition risks. The 2031 price shock can be offset by earlier implementation of environmental and energy transition programmes to ensure sufficient profitability and liquidity. The NDC Soft scenario can be applied by 2020s to support the implementation of the NDC by the Government of Kazakhstan, while Net Zero Soft by 2030s and beyond to support energy transition policies and achieve carbon neutrality by 2060.

- The hard versions of NDC and Net Zero scenarios are less realistic and are used rather to test the financial sensitivity of shock scenarios for the financial position of Samruk-Energy JSC. Given the fact that the Government of Kazakhstan is constantly postponing the introduction of CO2 pricing within the framework already established by KazETS, following the NGFS pricing trends is less realistic.

Two most probable scenarios – NDC Soft and Net Zero Soft – are acceptable for the Group of companies of Samruk-Energy JSC. The respective impact can be assessed as low and medium, respectively, if there are management levers to compensate for it.

The hard versions of the NDC and Net Zero scenarios are less realistic, not applicable, and should be offset by one of the mitigation strategies or a combination of both.

Climate change strategy

Samruk-Energy JSC's efforts to combat climate change are one of the key components of the Company's strategy both in the short and long term. We fulfil our role through identifying the best adaptation measures to adjust to changes that will inevitably occur to a greater or lesser extent, with greater or lesser frequency and intensity.

Adaptation includes all initiatives undertaken by the Company to improve the resilience of its assets, increase its ability to respond to extreme climate events and develop strategic options and business models that will address different needs in the face of climate change.

The Company is leading the energy transition through decarbonisation of electricity generation, increasing the share of RES, reducing pollutant emissions, and implementing new investment projects. These factors present opportunities both to increase value creation for all stakeholders and to more rapidly achieve the goals of the Paris Agreement as well as the Sustainable Development Goals defined by the United Nations in the 2030 Agenda.

In particular, the main climate and environmental mitigation actions undertaken by the Group are as follows:

- Increasing the share of RES. Samruk-Energy JSC aims at increasing the share of renewable energy sources in its generation and reducing the negative impact on the environment. The Company focuses on the development of alternative energy sources such as RES and hydro generation. The company plans to modernise existing RES facilities and build new ones, as well as expand hydroelectric power plants. Already now Samruk-Energy provides more than 70% of RES capacity in Kazakhstan, and in the future the company plans to increase this share by implementing projects in partnership with international strategic partners.

- Redistribution of the generation structure. Comparing the growth rates of RES and coal-fired plants, Samruk- Energy plans to significantly outpace traditional energy sources by increasing the share of RES in capacity growth to 40%, while the share of coal-fired plants will be 34%. This will significantly change the generation structure towards more environmentally friendly and sustainable energy sources.

- Decarbonisation and reduction of carbon footprint. Until 2033, Samruk-Energy JSC's activities to reduce net carbon footprint will focus on increasing the share of RES in the power generation structure, implementation of carbon offset and climate projects. It is also planned to introduce new technologies and implement climate projects that contribute to the reduction of net greenhouse gas emissions.

- Implementation of RES and HPP investment projects and international co-operation. A key objective of the energy transition is the construction of new RES and HPP facilities. RES will provide a 6.2 GW (40%) capacity increase, including large-scale wind and solar projects with energy storage in co-operation with international partners. The development of hydro generation involves both the construction of new plants and modernisation of existing ones, providing an increase of 1.6 GW (10%). These measures will significantly increase the share of clean energy in the overall energy mix.

- Introduction of waste recycling and utilisation practices (use of ash slag). Adopting recycling practices reduces environmental impact and carbon footprint, supporting a circular economy. In the power sector, ash slags can be used in the production of building materials, replacing part of the original components, which reduces costs and saves natural resources.

- Ensuring stable power supply from RES generation facilities through the use of energy storage systems. Electricity generation from renewable energy facilities strongly depends on weather conditions (wind speed for wind turbines) and time of day (light level for solar power plants), so the introduction of energy storage and accumulation systems at RES facilities will ensure stable electricity supply to consumers during periods of high demand and peak power consumption, as it will make it possible to accumulate previously generated electricity from RES facilities and release it to the grid during the next few hours.

Climate risks and opportunities

As part of its strategic approach to climate risk management, Samruk-Energy JSC pays special attention to the opportunities offered by the transition to a green economy. We strive to use less carbon-intensive technologies and consider energy efficiency as a priority to achieve our climate goals. This includes developing and implementing new processes and technologies to reduce energy intensity, as well as investing in equipment modernisation and technologies that reduce greenhouse gas emissions.

Climatic possibilities

Resource efficiency

We see an opportunity in implementing energy efficiency and conservation measures, and are committed to the efficient use of resources, including fuel, energy and water.

The main measure to improve energy saving and energy efficiency is the rational use of fuel and energy resources through the use of innovative technologies, modernisation and technical re-equipment of equipment.

Implementation of the planned energy saving and energy efficiency measures will reduce specific fuel consumption per unit of production, thus reducing specific CO2 emissions per unit of production.

Application of new technologies

Study and subsequent introduction of new modern technologies for carbon capture, utilisation and storage as a key factor in achieving climate goals and meeting the energy needs of society to reduce anthropogenic CO2 emissions and reduce the carbon intensity of products.

In the next reporting periods, we plan to deepen disclosure of information on the impact of climate change issues on the Company, risks and opportunities in accordance with the international TCFD methodology (Recommendations for Reflecting the Impact of Climate Risks in Financial Reporting).

Risk management

Managing climate and environmental risks is key to delivering our Strategy, helping the transition to a low carbon economy, and fulfilling our ambitions to achieve zero carbon emissions by 2060.

In December 2024, the Company identified Climatic Physical Risks and Climatic Transition Risks, which were included in the Consolidated Risk Register and Risk Map for 2025.

The approach to risk identification was based on the recommendations of the Task Force on Climaterelated Financial Disclosures (TCFD), which provided a comprehensive analysis of both current climate risks and prospective changes in the company's activities in the process of transition to carbon neutrality.

| Physical risk factors | Transitional risk factors |

|---|---|

Chronic phenomena

|

Political and regulatory risks

Technological risks

Market risks

Reputational risks

|

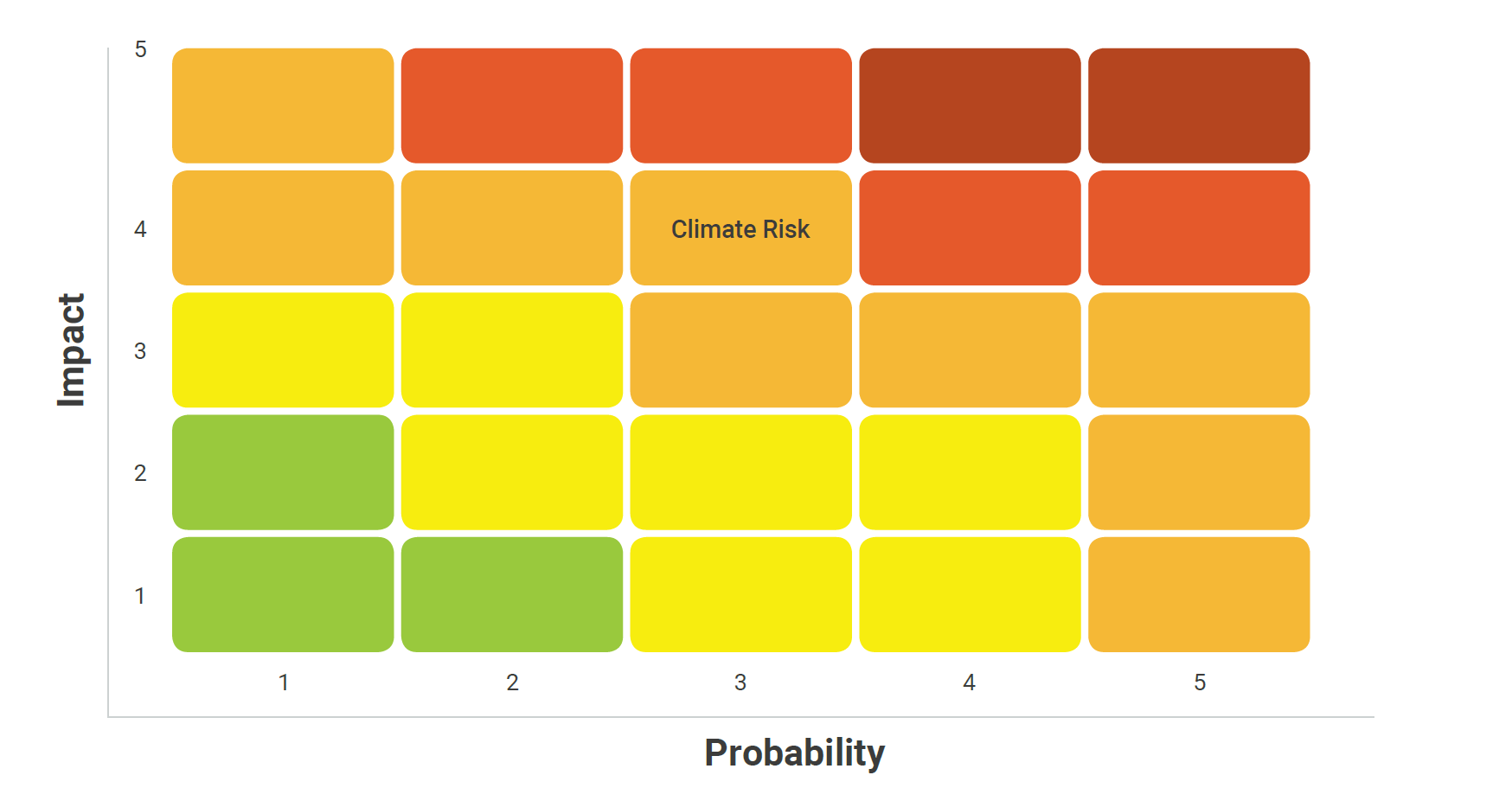

Within the framework of risk assessment and analysis in Samruk-Energy JSC, qualitative, quantitative analyses or their combination are used, which create a methodological basis for the risk management process.

Risk assessment includes consideration of the sources and causes of each risk, the negative consequences if they materialise, and the likelihood that a particular risk will materialise.

All risks are reflected on the Risk Map, where one axis shows their significance and the other axis shows their probability of occurrence.

Climate Risk Assessment on the Risk Map for 2024

In order to improve the efficiency of risk monitoring, Samruk-Energy JSC applies KRIs (key risk indicators) using two approaches:

- Based on risk factors – risk factors for each key risk are determined. Risk factors can be both external and internal to Samruk-Energy JSC. Risk factors are analysed for measurability. For each risk factor, appropriate measurement units and frequency of measurement of the indicator are determined, which can be expressed in the form of coefficients, per cent, numbers, etc.

- Based on preventive measures for risk management, the structural subdivision responsible for risk management together with the involved structural subdivisions of Samruk-Energy JSC and/or subsidiaries and affiliates determine the unit of measurement of the level of performance for each preventive measure for risk management, the frequency of measurement of the indicator and the source of information for calculation. The KRI developed on the basis of preventive measures can be expressed in percentage terms or in the actual performance of preventive measures.

Risk management activities

To effectively manage climate risks and adapt to their potential impact, Samruk-Energy JSC has developed a comprehensive action plan aimed at reducing environmental risks and complying with legislation. The following actions are envisaged within this plan:

- Monitoring compliance with environmental and water resources legislation, including deadlines for submitting applications for emission permits and reporting to state regulatory authorities;

- Monitoring of the use of quotas for greenhouse gas emissions with possible adjustment of limits;

- Monitoring compliance with environmental equipment modernisation and repair plans;

- Compliance with technical regulations and rules of operation of buildings and structures;

- Mandatory environmental insurance and establishment of liquidation funds;

- Interaction with state authorities in the process of developing regulations in the field of environmental protection

- Monitoring the implementation of international environmental standards and environmental management;

- Control of budget execution for environmental protection;

- Assessment of the impact of economic activities on aquatic ecosystems and flora and fauna.

Measures to manage risks associated with greenhouse gas emissions into the atmosphere and mitigate related environmental impacts:

|

Alternative energy |

|

|

Traditional energy |

|

|

Grid infrastructure and regulation |

|

|

Emissions management |

|

|

Supporting activities |

|

Results of climate change mitigation activities

To achieve carbon neutrality at a global level, we have developed targets and implemented key indicators to effectively manage our operations and reduce our carbon footprint.

Medium- and long-term objectives of the Energy Transition Programme of Samruk-Energy JSC

2031

- Obtaining an ESG rating in 2023 and its subsequent improvement

- Explore and implement Carbon Capture & Storage technologies

2060

- Explore and implement Carbon Capture & Storage technologies

Progress in achieving the goals of Samruk-Energy JSC in 2024

| Indicator | 2021, Base year | 2023 | 2024 | Target 2060* |

|---|---|---|---|---|

| Net carbon footprint reduction, million tonnes CO2 | 32.95 | 31.87 | 30.88 | 0 |

| Forest-climatic project, ha | 0 | starting in 2045 | starting in 2045 | 1,000 Ha |

* In the “deep decarbonisation” scenario.

In 2024, 8 new RES facilities with a capacity of 163.5 MW were commissioned in Kazakhstan. In 2014, the installed capacity of RES facilities in operation in the country was 177.52 MW, and in 2024 it exceeded 3,032 MW.

In 2024, Samruk-Energy JSC considered the possibility of offsetting the negative environmental impact from production activities by obtaining carbon (offset) units. One offset unit is equivalent to one metric tonne of CO₂.

Within the framework of implementation of the Action Plan on management of environmental protection issues in the Samruk-Energy JSC Group of companies for 2024, the Roadmap for obtaining offset units of subsidiaries and affiliates (HPPs) was approved. In accordance with the Rules for Approval of Carbon Offset and Provision of Offset Units43, the relevant project concepts were developed.

43 Order of the Acting Minister of Ecology, Geology and Natural Resources of the Republic of Kazakhstan dated 5 November 2021 No.455, SAC (HPP).

However, the authorised body returned the submitted documents for revision. The reason was the provision of the Large-Scale Consolidated Methodology ACM0002 “Production of electricity from RES connected to the grid”, according to which HPPs can receive offset units only for the volumes of electricity produced after modernisation or reconstruction of facilities.

Currently, all comments have been taken into account and the documents are planned to be resubmitted for review in 2025. For the rest of the Company's RES facilities (except for HPPs), receipt of offset units for 2024 is also planned for 2025.

Additionally, obtaining international I-REC certificates is considered as an alternative mechanism, which will not only confirm the origin of the produced “clean” energy, but also generate additional revenues and stimulate the development of existing RES facilities.

Indicators related to climate change

| Indicator | 2022 | 2023 | 2024 |

|---|---|---|---|

| Greenhouse gases | |||

| Scope 1, tonnes CO2e | |||

| Carbon dioxide (CO2) | 31,978,242 | 31,877,469 | 30,883,547 |

| Methane (CH4) | 940,989 | 1,065,127 | 1,058,713 |

| Nitrous oxide (N2O) | 74,182 | 66,980 | 64,326 |

| Scope 2, tonnes CO2e | |||

| CO2 | 13,334 | 11,343 | 13,883 |

| Electricity generation | 1,527 | 1,415 | 1,515 |

| Heat generation | 11,807 | 9,928 | 12,368 |

| Pollutant emissions | |||

| Dynamics of specific atmospheric emissions per unit of production, g/kWh | 9.48 | 9.54 | 8.22 |

| Energy efficiency | |||

| Total energy saving, thousand GJ | 14,271 | 10,043 | 9,192 |

| Responsible water use | |||

| Volume of reused water | 7,327 | 8,328 | 8,620 |

| Volume of recycled water | 3,534,517 | 3,499,210 | 3,549,726 |

| Volume of TPP water intake per unit of output | 6.30 | 7.03 | 6.81 |

| Waste management | |||

| Total waste generated, of which: | 89,929,927 | 98,496,096 | 108,784,900 |

| Hazardous, tonnes | 647 | 1,732 | 534 |

| Non-hazardous, tonnes | 89,928,281 | 98,496,364 | 108,784,366 |

| of which by main types of waste characteristic of the specifics of production, tonnes | 89,912,725 | 98,474,212 | 108,760,267 |

| ash and slag waste, tonnes | 7,129,158 | 8,853,230 | 8,781,174 |

| overburden, tonnes | 82,783,567 | 89,620,982 | 99,979,093 |

| Biodiversity conservation | |||

| Investments in biodiversity conservation, million KZT | 57.9 | 114.7 | 224.1 |

Greenhouse gas emissions

The EU taxonomy includes specific criteria for determining a significant contribution to climate change mitigation. Hydropower plants meet the significant contribution criteria (SCC) if the plant is a riverine plant without an artificial reservoir, or if the specific power of the plant exceeds 5 W/m2, or if the lifetime emissions are below 100 g CO2/kWh.

In Samruk-Energy JSC, the declared criterion is met by: Moynak HPP – 28.7 W/m2, Almaty HPP cascade – 54.6 W/m2, UKHPP – 9.7 W/m2. Not satisfied: Kapshagay HPP – 0.26 W/m2, Shardara HPP – 0.14 W/m2, Shulbinsk HPP – 2.75 W/m2.

There are no CO2 emissions from the hydropower plant.

In accordance with the legislation of the Republic of Kazakhstan, enterprises, including EGRES-1 LLP, SEGRES-2 JSC, AlES JSC and Bogatyr Coal LLP, subject to the greenhouse gas emissions quota system, are required to conduct an inventory of these emissions. The inventory process includes certification of the results by an independent accredited organisation, which ensures transparency and reliability of emissions data.

In 2024, the costs of climate risk management measures totalled about KZT 8.6 million, including the development and verification of the Report on greenhouse gas inventory for quota installations of Samruk-Energy JSC.

Direct emissions of EGRES-1 LLP, SEGRES-2 JSC, and AlES JSC, originating from fuel combustion in boiler units for electricity and heat generation, and from coal mining at Bogatyr Coal LLP, belong to coverage category 1. Emissions data are collected from primary sources such as official technical reports and laboratory logs. These data are processed in accordance with national methodologies and guidelines specified in the GHG Protocol Scope 1 Guidance. Based on the collected data, GHG emission factors and their total amount are calculated for each source and each enterprise: EGRES-1 LLP, SEGRES-2 JSC, AlES JSC and Bogatyr Coal LLP. The calculations include analysis of emissions from boiler equipment and coal mining, and are confirmed by independent accredited organisations for each subsidiary.

To analyse greenhouse gas emissions, accurate measurements of feedstock consumption and characteristics are made, including the volume of fuel consumed, its composition (carbon content, lower heating value), and heat losses caused by incomplete combustion of the fuel. The conversion of methane and nitrous oxide emissions into equivalent tonnes of carbon dioxide shall apply the current global warming potential coefficients (28 for methane and 265 for nitrous oxide) determined in accordance with paragraph 4 of Decision of the Conference of the Parties 6/CP.27 dated 17 November 2022.

Direct GHG emissions44 (Scope 1), tonnes CO2-eq45,46

| Indicator | Units of measurement | 2022 | 2023 | 2024 | Δ 2024/2023, % |

|---|---|---|---|---|---|

| Carbon dioxide (CO2) | tonnes of CO2 | 31,978,242 | 31,877,469 | 30,883,547 | -3.1 |

| Methane (CH4) | tonnes of CO2 eq. | 940,989 | 1,065,127 | 1,058,713 | -0.6 |

| Nitrous oxide (N2O) | tonnes of CO2 eq. | 74,182 | 66,980 | 64,326 | -4.0 |

44 The volume of direct greenhouse gas emissions is given for EGRES-1, EGRES-2, AlES, Bogatyr Coal.

45 The Company does not calculate biogenic greenhouse gas emissions.

46 The Company has chosen the control-based consolidation method. In determining the total volume of greenhouse gases, 100% of emissions from those consolidated facilities controlled by the Company are taken into account.

All Scope 1 emissions showed a reduction in 2024 compared to 2023. This demonstrates the Company's success in reducing its carbon footprint. We continue to implement environmentally friendly technologies and improve processes, which helps not only to improve the environmental situation, but also to strengthen our reputation as a sustainabilityoriented Company.

Specific GHG emissions (Scope 1)

| Type of activity | Units of measurement | 2021 | 2022 | 2023 | 2024 | Δ 2024/2023, % |

|---|---|---|---|---|---|---|

| Electricity generation | tonnes CO2eq/ thousand kWh | 0.862 | 0.831 | 0.838 | 0.728 | -13.1 |

| Heat generation | tonnes of CO2eq/ thousand Gcal | 324.485 | 318.530 | 294.127 | 288.945 | -1.76 |

| Coal mining | tonnes CO2eq/ thousand tonnes | 173.552 | 33.519 | 35.549 | 25.978 | -26.9 |

According to the results of 2024, there is a decrease in specific GHG emissions by all types of activities of Samruk-Energy JSC compared to 2023. The following key factors contributed to this:

- increase in RES electricity production by 2.6 times – from 2.849 billion kWh to 7.460 billion kWh;

- reduction of specific consumption of fuel equivalent for heat energy supply at EGRES-1 LLP from 161.0 kg/ Gcal to 156.7 kg/Gcal;

- reduction in the volume of stockpiled internal overburden at Bogatyr Coal LLP from 3.084 million tonnes to 2.652 million tonnes.

The Company calculates indirect emissions in accordance with the approved Instruction on calculation of greenhouse gases and offset units for the Samruk-Energy JSC Group of companies based on the GHG Protocol Scope 2 Guidance, as well as on the list of benchmarks in regulated sectors of the economy approved by the Order of the Acting Minister of Ecology, Geology and Natural Resources of the Republic of Kazakhstan No. 260 dated 19 July 2021.

Due to the changes in the energy supply system in the Republic of Kazakhstan, caused by the introduction of the Unified Electricity Purchaser from 1 July 2023 – hereinafter referred to as the SEP, companies have the opportunity to apply both the location-based method and the market-based method to calculate indirect energy GHG emissions in Scope 2. In accordance with the GHG Protocol, the purchase of electricity from the SEP in the Samruk-Energy JSC Group of companies is considered as buy-back contracts from the point of view of prospects for the purposes of consolidation of the group. Therefore, only market-based method based on direct contracts (market-based) is applied for calculation of Scope 2.

Indirect GHG emissions (Scope 2), tonnes CO2-eq47

| Indicator | 2022 | 2023 | 2024 | Δ 2024/2023, % |

|---|---|---|---|---|

| Gross indirect greenhouse gas emissions (Scope 2) | 13,334 | 11,344 | 13,883 | 22.4 |

| Gases included in the calculation | CO2 | CO2 | CO2 |

47 The perimeter of the indicator includes data on purchased external energy of Bogatyr Coal LLP.

In 2024, indirect Scope 2 emissions increase by 22.4% compared to 2023, reaching 0.014 million tonnes of CO2. The increase is due to increased consumption of purchased heat.

Samruk-Energy JSC in 2025 plans to analyse Scope 3 greenhouse gas emission categories, which take into account all indirect emissions not covered by Scopes 1 and 2. Currently, these emissions are not subject to mandatory reporting under the GHG Protocol standard.

Indirect emissions in Scope 3 are divided into 15 categories and classified into Upstream emissions and Downstream emissions. Upstream emissions include emissions from purchased raw materials, goods and services, excluding those reported in Scopes 1 and 2. Downstream emissions include emissions associated with the operation and end-of-life of products outside the organisation.

After approval of the categorisation, Samruk-Energy JSC plans to gradually introduce accounting and monitoring of Scope 3 emissions in 2025-2026.

In 2024, implementation of energy efficiency and energy saving measures at Almaty TPPs (AlES JSC) contributed to reduction of GHG emissions by 17.587 thousand tonnes of CO2. Among the implemented measures, replacement of air heater cubes of the 1st stage of boilers No. 2, 5 and 6 of CHPP-2 saved 8.9 thousand tonnes of coal, as well as a number of other measures aimed at improving energy efficiency.

Greenhouse gas emission reductions, tonnes CO2

| Company | Event | 2023 | 2024 |

|---|---|---|---|

| ALES JSC | Implementation of energy efficiency and energy saving measures | 26,588 | 17,587 |

| EGRES-1 LLP | Buying carbon offset | 387,150 | - |

| Total for Samruk-Energy JSC | 413,738 | 17,587 | |

Energy efficiency

Samruk-Energy JSC continues to work on improving the energy efficiency of its enterprises to reduce environmental impact and support the fight against climate change. We implement innovative solutions and optimisation measures to reduce consumption of energy and natural resources.

The Company has an Energy Saving and Energy Efficiency Improvement Programme for 2015-2025. The Programme is a fundamental document for planning and implementing activities in the field of energy saving and energy efficiency improvement and is aimed at reducing the energy intensity of products and improving the energy efficiency of subsidiaries. This is achieved through rational use of resources, reduction of environmental impact and fulfilment of established targets.

The main tools of the Programme are:

- Establishment of key indicators for energy savings.

- Ongoing monitoring and analysis of goal achievement.

- Implementation of measures to improve energy efficiency.

In November 2024, we successfully passed a surveillance audit of our corporate management system and confirmed compliance with the requirements of international standards ISO 9001, ISO 14001, ISO 45001, ISO 50001, ISO 37001.

Energy saving and energy efficiency improvement measures

The main reliability indicators are the reduction in the number of process failures. Thanks to the implementation of the planned measures, daily work of power engineers, phased reconstruction of power facilities and financial investments, we managed to reduce the number of process failures by 11%.

In accordance with the Law of the Republic of Kazakhstan On Energy Saving and Energy Efficiency Improvement, energy audits were conducted at the facilities of SEGRES-2 JSC and AlES JSC in 2024.

A total of 67 measures were implemented, including work at the Eastern HPPs, aimed at improving energy efficiency and rational use of resources. This allowed saving more than KZT 1.2 billion.

In 2024, the total energy consumption is 195,026 thousand GJ, a decrease of 2.5 per cent compared to 2023 (200,194 thousand GJ).

Implementation of measures to improve energy efficiency in the Samruk-Energy JSC Group of companies made it possible to reduce energy consumption up to 9,192 thousand GJ (for details, see Appendix Resource Consumption and Energy Efficiency).

Key energy indicators, thousand GJ

| Energy reduction | 2022 | 2023 | 2024 | Δ 2024/2023, % |

|---|---|---|---|---|

| Amount of energy savings | 14,271 | 10,043 | 9,291 | 8.4 |

Participation of Samruk-Energy JSC employees in the VI International Energy Saving Forum

On 8 November 2024, on the eve of the International Energy Saving Day, employees of Samruk-Energy JSC took an active part in the VI International Energy Saving Forum held in Astana. The Forum became an important platform for discussing key issues in the field of energy saving and energy efficiency at the level of both the public sector and business.

The event touched upon issues related to the development of energy saving policy in Kazakhstan, as well as exchange of experience and best practices between representatives of government agencies, business, non-governmental organisations and the expert community.

Special attention at the forum was paid to the issues of decarbonisation of industry, introduction of automation and digitalisation technologies, as well as standardisation of energy saving in the country. Participation in such an event allowed Samruk-Energy JSC to keep abreast of modern trends and initiatives in the field of sustainable development, as well as to strengthen its role in promoting effective practices of energy saving and energy efficiency improvement.

The most impactful energy efficiency measures:

- Increasing the capacity of power units.

- Increase of operation time of power units with power supply from IV turbine extraction.

- Cleaning of heat-exchange surfaces of turbine condenser.

- Conducting equipment set-up.

- Sealing of the boiler gas ducts furnace.

- Replacement of heat insulation of heat network pipelines..

Due to the implemented measures aimed at energy efficiency, electricity consumption for own needs of Samruk- Energy JSC's EPO was 5.41% against the plan of 5.67%.

Energy availability

Kazakhstan has highly developed energy systems that provide a stable electricity supply for both the population and industry. The energy industry is regulated by the Ministry of Energy of the Republic of Kazakhstan, which also oversees the utilisation of renewable energy sources. The Natural Monopolies Regulation Committee of the Ministry of National Economy oversees the regulation of electricity and heat transmission services, and the Ministry of Industry and Infrastructural Development oversees the coal industry.

According to the Ministry of Energy of the Republic of Kazakhstan, more than 99% of the country's population has access to electricity. In rural areas, programmes are being implemented to modernise power grids and improve the quality of electricity supply, which helps to reduce the urban-rural gap.

In the Samruk-Energy Group of companies, all generating companies sell electricity through the Unified Purchaser. This process is centrally controlled by a legal entity with state participation, which ensures efficient purchase and sale of electricity.

Our subsidiaries, such as AlmatyEnergoSbyt LLP, are responsible for electricity sales, while Bogatyr Coal LLP is responsible for coal sales. In turn, Alatau Zharyk Company JSC provides technical conditions for connection to the electricity grid.

The Group of companies regularly monitors power supply reliability indicators, such as energy losses and technical violations, as well as reliability coefficients (SAIFI, SAIDI). The Company has an annual tendency to reduce grid losses.

Network losses at AzhK JSC, %

| Name | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Regulatory losses | 14.4 | 12.9 | 12.8 | 12.8 | 12.7 |

| Actual losses | 12.6 | 11.9 | 11.4 | 10.9 | 10.7 |

Electricity losses in the networks of AZhK JSC are calculated as the ratio of total actual losses to the volume of electricity received into the AZhK JSC network.

Taking into account the annual growth of consumers, AZhK JSC has a tendency to improve the indicators of outages (SAIFI) and duration of outages per consumer per calendar year (SAIDI). Reliability indicators have improved due to the implementation of measures aimed at reducing the number of outages and their duration.

Number of outages and duration of outages:

- SAIFI in 2024 is 2.61, which is below the normative indicator (3.7).

- SAIDI in 2024 was 3.19 hours, which is also compliant with regulations.

For more details see the Appendix AZhK JSC Supply Reliability Indicators Report 2017-2024, SAIDI, SAIFI.

Access to services and improvement of customer service

For the convenience of customers, Alatau Zharyk Company JSC provides access to basic services through its веб-сайт. On the website it is possible to obtain technical conditions for connection, familiarise yourself with disconnection schedules and tariffs, as well as submit applications for connection to the power grid. In addition, at AZhK JSC, the service Issuance of technical conditions has been fully converted to electronic format and is provided through the IS TU Module. The information system allows to submit an application for technical specifications online, track the status of the submitted application, and receive the prepared technical specifications in the form of a digital copy in pdf format. Preparation and issuance of acts of delineation of balance and operational responsibility of the parties are carried out in accordance with the Rules for the Use of Electricity. Formation and issuance of balance separation acts was carried out via IS TU Module.

AlmatyEnergoSbyt LLP offers differentiated tariffs for various categories of consumers, including benefits for pensioners and disabled people. Details are available at the link: https://esalmaty.kz/ru/home-tariffs/1level-2.

Bogatyr Coal LLP, in turn, actively participates in social support by providing coal for social facilities and charitable organisations. In 2024, more than 160 thousand tonnes of coal were shipped for social needs and charitable purposes. For more information, please visit: http://www.bogatyr.kz/ru/social/social_report/.

Initiatives to improve the quality of production processes aimed at resource saving

Samruk-Energy JSC actively introduces innovations to improve energy efficiency and reduce environmental impact.

During the implementation of rationalisation proposals, special attention was paid to energy efficiency. The main objective was to reduce energy consumption without compromising the quality of production processes.

The measures implemented have made it possible to:

- reduce the consumption of resources;

- reduce energy losses by optimising process modes;

- introduce automated systems for control and metering of energy resources.

The most significant of these include optimising losses of chemically desalinated water, improving locomotive maintenance and speeding up equipment cleaning at thermal power plants.

Plans for 2025 and the medium term

- It is planned to update the Energy Saving and

Energy Efficiency Improvement Programme taking

into account modern challenges and sustainable

development priorities, in the following key areas:

- Optimisation of the use of electricity, heat, coal and other resources.

- Improving energy efficiency of equipment, engineering systems and production processes.

- Reduction of energy costs.

- Improving the economic efficiency of production activities.

- Reduction of greenhouse gas emissions.

- Minimising the negative impact on the environment.

- Introduction of modern energy efficient technologies and equipment.

- Transition to energy efficient solutions (LED lighting, automated control systems, etc.).

- Awareness raising and training of staff and the public.

- Advocating responsible and sustainable consumption of resources.

- Strengthening resilience to potential energy crises and external risks.

- It is planned to implement 65 measures aimed at energy saving and energy efficiency improvement, with an expected economic effect of more than KZT 1 billion.

- Energy audits are planned at AES Shulbinsk HPP LLP, Bogatyr Coal LLP and Moynak HPP JSC to identify opportunities to improve energy efficiency.