Development Strategy

New Strategy 2024-2033

On 19 July 2024, the Board of Directors of Samruk-Energy JSC approved the Development Strategy of Samruk-Energy JSC for 2024–2033 (hereinafter – the Strategy). The new Strategy takes into account global and internal changes in the energy sector, aims to develop renewable energy sources (RES), improve efficiency and reliability of energy supply, and implement ESG principles.

Key trends and challenges

- An energy deficit of 2.8 GW is forecast by 2024 and 6.2 GW by 2030. This requires urgent commissioning of new baseload capacity, including construction of coal-fired plants and expansion of gasfired generation.

- It is planned to increase the capacity of RES projects by 6.2 GW by 2030. However, the accelerated development of RES creates a need for the construction of manoeuvring capacities, such as SGP in Turkestan and Kyzylorda, as well as new HPPs and PSPPs.

- To improve the efficiency of asset management, the assets are being restructured. In particular, it is considered expedient to transfer RES and HPP assets to a separate legal structure under control, specialising in the development of green energy - Public Company Qazaq Green Power PLC.

- The introduction of the Unified Electricity Purchaser and balancing market leads to a revision of the Tariff Policy. This requires adaptation of investment mechanisms and new ways to return investments in the energy sector.

- Deleveraging remains a priority and funds are being raised through green bonds and other sustainable financial instruments to finance new projects.

- The Company follows the national strategy of carbon neutrality until 2060. This increases the investment attractiveness of RES and stimulates the development of green finance, including the issuance of ESG bonds.

- Automated emission monitoring systems, digital solutions for energy management and artificial intelligence in load forecasting are being introduced to improve the efficiency of the energy system.

- New tariff setting standards and support mechanisms for strategic projects aimed at ensuring stable energy supply and accelerated transition to RES are being introduced at the state level.

- New vector for regional heat supply, construction of CHPPs in Kokshetau, Ust-Kamenogorsk, Semey and transfer of Ekibastuz CHPP into trust management.

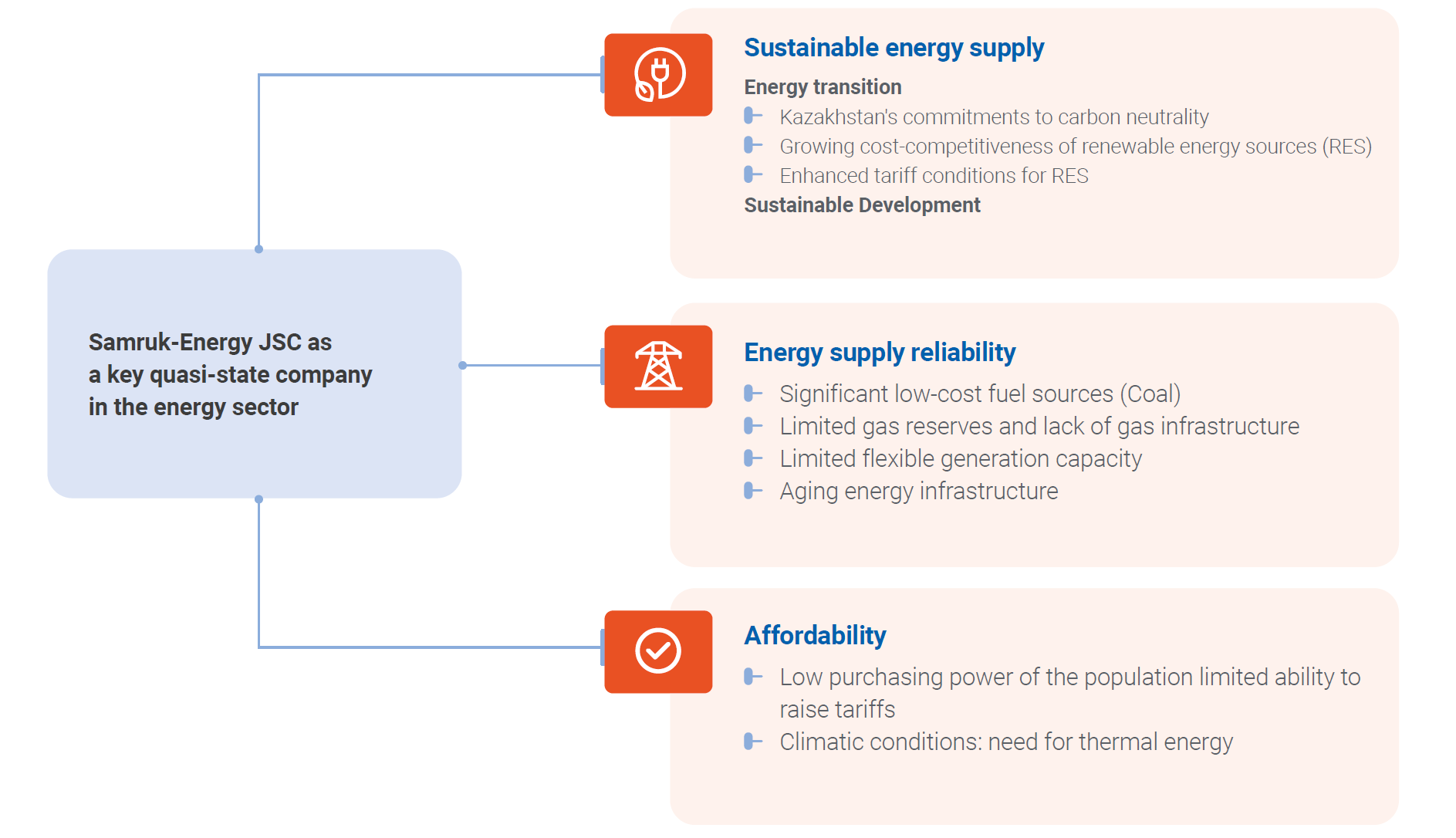

The energy trilemma shapes the external environment and development path of Samruk-EnergyJSC

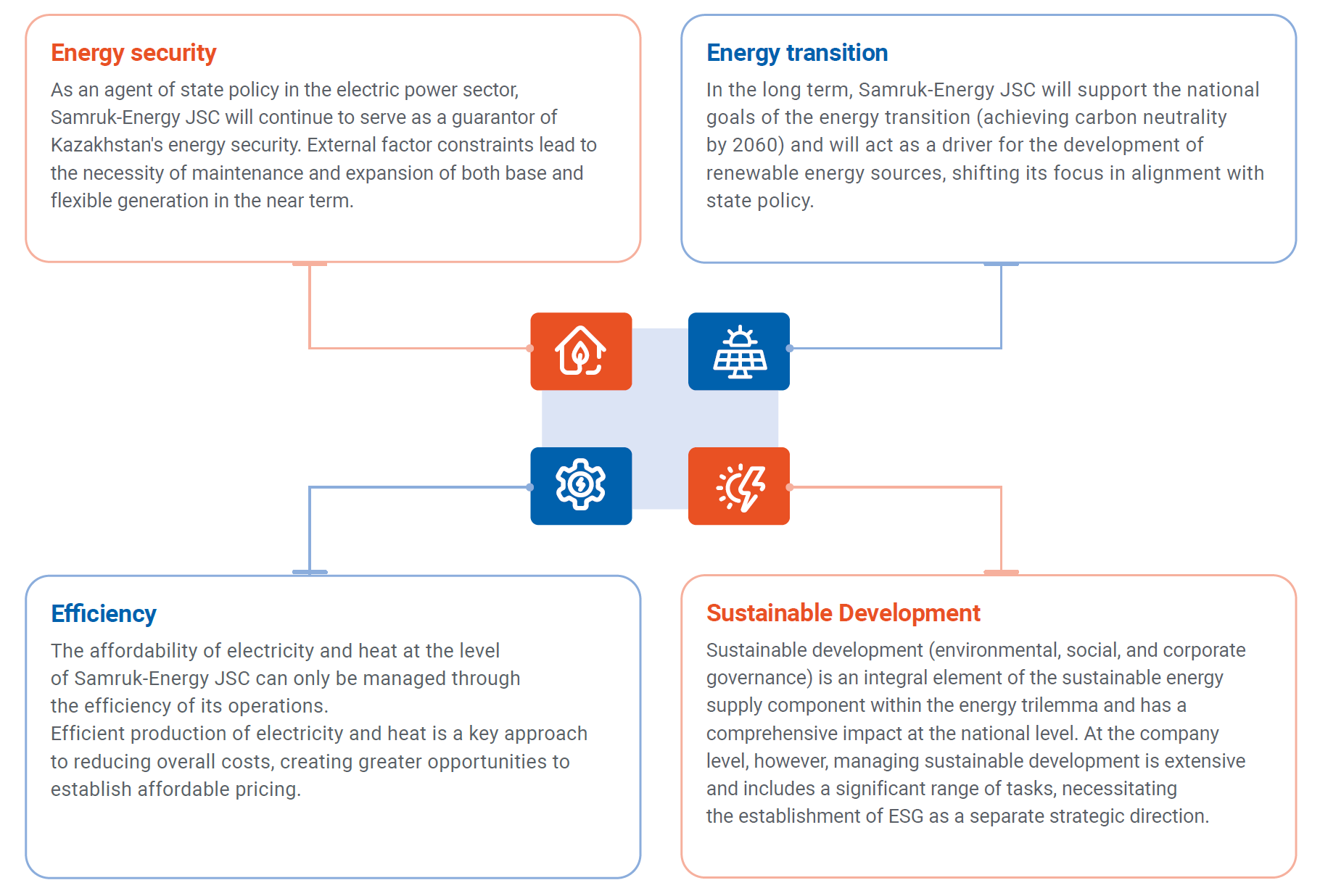

Priorities of Samruk-Energy JSC – Energy security, Energy transition, Sustainable development and Efficiency

Linking the energy sector trilemma to the strategic development directions of Samruk-Energy JSC

Strategic Directions, Goals, Objectives and KPIs

| Strategic directions | Energy security | Efficiency | Energy transition | Sustainable development |

|---|---|---|---|---|

| Strategic goals | Ensuring coverage of the economy's growing demand for electric capacity and electricity | Improving efficiency of operating, financial and investment activities | Advance development of RES and reduction of negative impact on the environment | Following the best ESG practitioners |

| Objectives |

|

|

|

|

| KPIs |

|

|

|

|

Taking into account the approval of the Development Strategy for 2024–2033, strategic performance indicators have been defined to achieve the relevant strategic development goals.

Strategic performance indicators according to Development Strategy 2024–2033.

| Goal | KPI | Unit of measurement | Forecast 2025 | Forecast 2027 | Forecast 2033 |

|---|---|---|---|---|---|

| Energy security | |||||

| Ensuring coverage of the economy’s growing demand for electricity power and electricity | Total volume of electricity sales from baseload and gas-fired generation | Coefficient to base year 2023 | ≥1 | ≥1.0 | ≥2.0 |

| Volume of commissioning of baseload and gas-fired generation capacities | GW, cumulative total from 2023 | ≥0.5 | ≥1.5 | ≥7.0 | |

| Technical availability factor (TAF) | % | ≥75% | ≥75% | ≥80% | |

| Implementation of the plan to meet coal requirements | % | ≥90% | ≥90% | ≥90% | |

| Efficiency | |||||

| Enhancement of operational, financial, and investment efficiency | Debt/EBITDA | Coefficient | ≤5.5 | ≤5.5 | ≤3.5 |

| Specific consumption of fuel equivalent | Gram per 1 kWh | ≤400 | ≤350 | ≤330 | |

| Investments in fixed assets | KZT trln, cumulative total from 2024 | ≥1 | ≥2.5 | ≥4.0 | |

| Gross inflow of foreign direct investment | billion USD, cumulative total from 2024 | ≥1.5 | ≥4.0 | ≥8.0 | |

| NAV | Coefficient to base year 2023 | ≥1.3 | ≥2.0 | — | |

| EBITDA margin by business segments | Coefficient to base year 2023 |

Coal mining (≥25%) Electricity generation (≥40%) Heat generation (≥20%) Electricity distribution (≥20%) |

Coal mining (≥25%) Electricity generation (≥45%) Heat generation (≥20%) Electricity distribution (≥20%) |

Coal mining (≥30%) Electricity generation (≥55%) Heat generation (≥20%) Electricity distribution (≥20%) |

|

| Energy transition | |||||

| Advanced development RES and reduction of negative impacts on environment | Reduction of specific CO₂-eq emissions (relative to the base year 2021) in relation to the total electricity generation | % to base 2021 year | ≥20% | ≥30% | ≥40% |

| Share of RES and HPP installed capacity in the generation structure | % | ≥25% | ≥25% | ≥40% | |

| Sustainable development | |||||

| Following the best ESG practitioners | Increase in ESG rating level | Rating | Medium ESG rating/ Medium Risks | Medium ESG rating/ Medium Risks | High ESG rating/ Low Risks |

| Improvement of social stability rating – SRS index | Rating | Conditionally stable | Stable | Favourable | |

| Achieving zero injuries and fatalities (reduction of LTIFR, FIFR, LDR) | Coefficient | LTIFR (0.26) FIFR (0.07) LDR (195) |

LTIFR (0.24) FIFR (0.01) LDR (185) |

LTIFR (0.18) FIFR (0.01) LDR (155) |

|

Several key bodies and subdivisions are responsible for the fulfilment of Samruk-Energy JSC's strategy. The Board of Directors approves the Company's development strategy, determines key performance indicators and controls the fulfilment of strategic goals. The Management Board is responsible for direct management of strategy implementation, coordinates the work of structural subdivisions and subsidiaries, and integrates sustainable development principles into key business processes. The Sustainability Management Board oversees compliance with ESG principles, strategic planning in this area and the implementation of relevant initiatives. In turn, responsible persons in structural divisions develop detailed action plans and monitor their implementation in their areas.

Strategy implementation is monitored through several mechanisms. Regular monitoring makes it possible to analyse the implementation of key performance indicators and, if necessary, to update strategic plans. An important role is played by monitoring the implementation of investment projects, which includes tracking timelines and budgets, as well as assessing their efficiency in accordance with the established strategic objectives. Post-investment monitoring allows us to assess the results achieved after the implementation of projects, analyse the return on investment and the impact of the implemented measures on the overall strategy of the Company.

Risks and challenges related to implementation of the development strategy

| Name of risk or threat | Risk management measures |

|---|---|

| Risks of ongoing/prospective investment projects and investment programmes |

|

| Risk of failure to fulfil the coal sales plan |

|

| Risk of failure to fulfil the electricity generation plan |

|

| Risk of failure to fulfil the electricity transmission and distribution plan |

|

| Risk of failure to fulfil the electricity sales plan |

|

| Procurement process risk |

|

| Risk of failure to fulfil the coal production plan |

|

| Risk of failure to fulfil the heat production and sales plan |

|

| Information security risk |

|

| Risks of information systems |

|

| Energy efficiency risks |

|

| Tariff setting risk |

|

| Credit risk of counterparty banks |

|

| Sanctions risk |

|

| Risk of violation of legislation and non-compliance with NAPs |

|

| Interest rate risk |

|

| Currency risk |

|

| Risks related to acquisition, disposal of shares/participatory interests in the charter capital of legal entities |

|

| Risk of failure to fulfil the Company’s Development Strategy |

|

| Risk of a terrorist attack |

|

| Risk of lack of liquidity for operating, investment and financing activities |

|

| Risk of breach of external creditors’ covenants and listing requirements |

|

| Asset impairment risk |

|

| Climate Transition Risks (entered into the Register by the decision of the Board of Directors dated 23 December 2024 (Minutes No.17/24)) |

|

| Environmental Risks |

|

| Risk of violation of the corporate governance regime |

|

| Risk of damage to health and life of employees in the course of fulfilment of their duties, industrial accidents |

|

| Risks of human resources of the Company’s Group |

|

| Risk of accidents and disasters at work |

|

| Risk of substandard insurance protection |

|

| Social risks |

|

| Risk of reputational damage |

|

| Fraud risk/corruption/Theft by staff and third parties |

|

| Climatic physical risks |

|

| Compliance risks |

|

Implementation of Samruk-Energy JSC development strategy in 2024

The strategic indicators of our Company demonstrate an improving trend. The main growth factors are an increase in sales of electricity and capacity on the domestic market, obtaining individual capacity tariffs, reducing specific fuel and water consumption for process needs, optimising fuel and energy costs and energy saving, as well as reducing the debt load.

Strategic performance indicators according to Development Strategy 2022–2031

| Indicator | Fact 2021 | Fact 2022 | Fact 2023 | Fact 2024 |

|---|---|---|---|---|

| Net carbon footprint reduction, thousand tonnes | 32,952 | 31,978 | 31,877 | 30,880 |

| Labour productivity22, thousand KZT/person | 10,154 | 13,273 | 14,872 | 56,234 |

| ROI (strategic ROI KPI will be applicable if assets are realised) | -12% | |||

| Net asset value (NAV), KZT million | 412,899 | 442,753 | 485,969 | 581,211 |

| Debt/EBITDA (ratio) | 2.41 | 1.90 | 1.71 | 1.66 |

| Corporate governance rating | BB | - | - | BB |

| Output of non-primary goods and services, thousand KZT | 332,537,144 | 381,464,992 | 444,959,627 | 573,489,842 |

Strategic performance indicators according to Development Strategy 2024–2033

| Purpose | EFFICIENCY | Unit of measurement | Plan 2024 | Fact 2024 | Forecast 2033 |

|---|---|---|---|---|---|

| Providing coverage growing demand economies on electrical power and electricity | Total volume of electricity sales from baseload and gas-fired generation | Coefficient to base year 2023 | 35.2 | 30.1 | ≥2.0 |

| Volume of commissioning of base and gas-fired generation capacities | GW, cumulative total from 2023 | 500 | 500 | ≥7.0 | |

| Technical availability factor (TAF) | % | 89.7% | 90.9% | ≥80% | |

| Implementation of the plan to meet coal requirements | % | 90% | 92% | ≥90% | |

| Enhancement of operational, financial, and investment efficiency | Debt/EBITDA | coefficient | 2.9 | 1.66 | ≤3.5 |

| Specific consumption of fuel equivalent | Grams per 1 kWh | 390 | 365 | ≤330 | |

| Investments in fixed assets | KZT trln, cumulative total from 2024 | 0.2 | 0.2 | ≥4.0 | |

| Gross inflow of foreign direct investment | billion USD, cumulative from 2024 | 0.1 | 0.1 | ≥8.0 | |

| NAV | Coefficient to base year 2023 | 1.3 | 1.2 | ≥2.0 | |

| EBITDA margin by business segments | Coefficient to base year 2023 |

Coal mining (22.3%) Electricity generation (44.4%) Heat generation (0.3%) Distribution of electricity (34.9%) |

Coal mining (15.1%) Electricity generation (50.6%) Heat generation (4.04%) Distribution of electricity (36.2%) |

Coal mining (≥30%) Electricity generation (≥55%) Heat generation (≥20%) Distribution of electricity (≥20%) |

|

| Advanced development RES and reduction of negative impacts on environment | Reduction of specific CO₂-eq emissions (relative to the base year 2021) in relation to the total electricity generation | % to base 2021 year | -25.6% | -28.9% | ≥40% |

| Share of RES and HPP installed capacity in the generation structure | % | 31.6% | 31.6% | ≥40% | |

| Following the best ESG practitioners | Increase in ESG rating level | Rating | “3”/52 points (average rating) | Average ESG rating/Medium Risks | High ESG rating/Low Risks |

| Improvement of social stability rating – SRS index | Rating | Conditionally stable | 69 | Favourable | |

| Achieving zero injuries and fatalities (reduction of LTIFR, FIFR, LDR) | coefficient | LTIFR (0.27) FIFR (0.10) LDR (200) |

LTIFR (0.99) FIFR (0.09) LDR (170.69) |

LTIFR (0.18) FIFR (0.01) LDR (155) |

The Company's strategic performance continues to improve. Key growth drivers include:

In the reporting period, the Company implemented the approved stages of initiatives and projects corresponding to the strategic goals and 24 key objectives agreed with the Samruk-Kazyna JSC.

| Strategic goal | Task | Event | Implementation status |

|---|---|---|---|

Ensuring coverage of the economy's growing demand for electric capacity and electricity |

Construction of coal-fired power plant GRES-3, blocks 1-4 | Pre-feasibility study results obtained | The pre-feasibility study project was developed, approved by the SE Board on 17.04.2025 and sent to the State Property and Privatisation Committee for further submission to the RK Ministry of Energy. |

| Transition of Bogatyr open-pit mine to cyclic-flow technology | Coal shipment started | Currently, the coal is being shipped by the CPT complex, and after completion of the commissioning and elimination of the existing remarks, the CPT will be put into commercial operation by the end of 2025. | |

| Modernisation of Almaty CHPP-2 | The documentation is subject to expert review | Receipt of the opinion is scheduled for August 2025. | |

| Reconstruction of Almaty CHPP-3 (450 MW CCGT) | Adjustments to the feasibility study | Receipt of the opinion is planned for July 2025. | |

| Modernisation of power unit No.3 of EGRES-1 | Feasibility study under examination | On 30 December 2024, a positive opinion was received from RSE Gosexpertiza on the feasibility study of the project. | |

| Expansion of EGRES-2 (installation of unit st. No. 3) | An investment agreement has been concluded | In September 2024, the Ministry of Energy of the Republic of Kazakhstan and GRES-2 JSC concluded an investment agreement for return of investments. | |

| Reconstruction of electrical networks Almaty | 102.22 km of 10 kV cable lines were laid | By the end of 2024, 102.22 km of 10 kV cable lines were laid, compared to the plan of 77.53 km. Construction and installation works for laying cable lines, procurement of cable and wiring products are underway. | |

| Rehabilitation of power unit No. 1 at EGRES-1 | Unit 1 is commissioned | The act of acceptance of the facility into operation dated 23 December 2024 was signed. | |

| Reduction of wear and tear of power grids | Planned reduction of depreciation to 88.85% by the end of 2024 | By the end of 2024, the depreciation of power grids will be reduced to 88.8%. | |

| Coal exports to the Russian Federation | Ensuring export of unprocessed coal to the Russian Federation (50% shareholding) | By the end of 2024, coal exports totalled 9.317 million tonnes. | |

| Reduction of losses in the networks of AZhK JSC | Reduction of the level of technological losses in 2024 to 11.25% | At the end of 2024, the level of actual technological losses for the reporting period was 10.72%. | |

Improving the efficiency of operating, financial and investment activities |

Implementation of the Energy Saving and Energy Efficiency Programme | Improvement of energy resource accounting; organisational, technical, repair, maintenance and operational measures | 67 different activities were implemented (including the Eastern HPPs). Implementation of measures to improve energy efficiency in the Samruk-Energy JSC Group of companies allowed saving more than KZT 1.2 billion. 54 rationalisation proposals with an economic effect of KZT 594 million were approved. |

| Redomiciliation of Forum Muider to the jurisdiction of AIFC | Cross-border merger of Forum Muider B.V. (Netherlands) into Forum Muider Ltd (Cyprus) | In November 2024, a court order was obtained from Nicosia (Cyprus) for the merger of Forum Muider B.V. (Netherlands) into Forum Muider Ltd (Cyprus). | |

| Liquidation of Ust-Kamenogorsk HPP JSC and Shulbinsk HPP JSC | Measures to liquidate Shulbinsk HPP JSC were carried out | Shulbinsk HPP JSC was liquidated. Start of measures on liquidation of Ust-Kamenogorsk HPP JSC is planned in the 2nd quarter of 2025. | |

| Automation of HR processes | Automation of HR processes for the Group of companies of Samruk-Energy JSC | The system has been implemented. The stage of customising the system to meet the requirements of the stakeholders is underway. | |

| Implementation of information security system | Information security services | Perimeter of information security system projects Corporate Centre and 9 subsidiaries and affiliates. Virtual server deployment with remote access, network and system configuration, running test scans according to specific techniques. Implementation period 2024–2025. | |

| Implementation of the production monitoring system | Production monitoring system (Situation Centre), which carries out monitoring of business processes related to the economic and production activities of the Company and making operational and managerial decisions | The system is operational in December 2024. | |

| Robotisation of business processes (RPA) | Services on the use of the business process robotisation software product | Analysed business processes in 8 subsidiaries and affiliates, described key marketing, procurement and finance processes, and implemented RPA bots in IBM to automate the processes. Implementation period – 2024–2025. | |

| Electronic archive | Automation of the business process of organising archival storage of documents | The work has been completed and the system has been put into operation. | |

| Compliance with financial covenants | Financial covenants of creditors are met | Debt/EBITDA – 1.62 with a threshold of no more than 3.5. EBITDA/interest – 12.23 with a threshold of less than 3.0. | |

| Implementation of the Modernisation of 1C platform project (ERP) | Works on implementation of an automated information system based on 1C:ERP software in GRES-1 | In 2024, EGRES-1 LLP completed such key stages of the project as: system customisation, user training, data migration (loading of NSI), software installation, test operation; data migration (transfer of balances and additional loading of NSI). | |

| Implementation of the Horizontal Monitoring project | Acquisition of Horizontal Monitoring licence in the KC of Samruk-Energy JSC | The licence has been purchased and the technical specification for the implementation of the Horizontal Monitoring project at the Corporate Centre will start in 2025. | |

| Installation at GRES-1 of an automated emission monitoring system into the environment (station-wide ASM) | Installation at GRES-1 of an automated system for monitoring emissions into the environment at power units st. No. 7 and 8 | Installation and commissioning works have been completed. Acts of putting the equipment into pilot operation were signed. | |

| Installation of an automated environmental emission monitoring system at GRES-2 | Installation of an automated emission monitoring system at GRES-2 | Since 26 June 2024, SEGRES-2 JSC has been transmitting data from the ASM to the system of the authorised body in the field of environmental protection every 20 minutes on a stream in online mode. The Commissioning Act has been signed. | |

| Installation of an automated system for monitoring emissions into the environment at AIES | Installation of an automated environmental emission monitoring system at CHPP-1 and ZTK (AIES) | Since 21 November 2024, CHPP-1 and ZTK (AIES JSC) have been transmitting data from the ASM to the system of the authorised body in the field of environmental protection every 20 minutes on the stream in online mode. Signed Acts of Completed Works. | |

| Installation of an automated environmental emission monitoring system at CHPP-2 (AIES) | Installation of an automated emission monitoring system at CHPP-2 (AIES) | Commissioning and test work is currently underway. Expected date for the start of data transfer to the system of the authorised body in the field of environmental protection – May 2025. | |

Advanced development of RES and reduction of environmental impact |

Construction of SPP (1 GW) with UNIGRIN ENERGY | The first stage contracts have been signed. The list of projects of the 2nd stage of 500 MW was approved |

Power purchase agreements were signed with PGU-Turkestan LLP, KEGOC and Kazatomprom. On 31 December 2024, a protocol was signed to define the 2nd phase of the project with a total capacity of up to 500 MW. |

| Carbon Capture and Storage (CCS) technologies | R&D with Nazarbayev University | According to the results of 2024, experiments were carried out on the laboratory unit of steam oxygen-free coal gasification (PBCGU), selectivity, permeability and efficiency of membrane materials with improved characteristics were studied. The influence of mode and design parameters on the coal steam gasification process was investigated. The report is presented, signed by AWR for 2024. |

|

| Sale of carbon units (offsets) and I-REC certificates | Contracts concluded | Consideration is being given to obtaining I-REC certificates. | |

| Placement of green bonds on KASE and AIX | Information about the Society is provided in AIX | All reports and information about the Company are submitted to AIX as required within the appropriate timeframe. | |

| Attracting funding from DFO, ECA | Received terms and conditions from MIGA | Received terms and conditions from MIGA as well as various proposals from commercial banks. | |

| Construction of a 1 GW wind power plant with energy storage system jointly with China Power International Holding Ltd. | Signed by the MEA | On 12 November 2024, an MEA was signed between the Governments of the Republic of Kazakhstan and the PRC on the implementation of RES projects. The project is included in the list of major projects. | |

| Construction of WPP (1 GW) with energy storage system together with Masdar | Signing of Project documentation (CoJ, SHA, PPA). Establishment of a joint venture | 11 November 2024 Qazaq Wind Power LLP project company is established on the basis of AIFC. In November 2024, the Investment Agreement and the Power Purchase Agreement under the project were signed. On 31 December 2024, the SHA was signed. | |

Adherence to ESG best practices |

Strengthening the quality and accessibility of information in public reporting by using international standards and developing best practices of information disclosure. Impact assessment and identification of material topics for the Integrated Annual Report |

The 2023 Integrated Annual Report has been prepared in accordance with GRI Standard 2021, AA1000, AIX, KASE, ISO 26000:2010, certain LSE indicators, IR, SASB, TCFD |

In determining material topics, the impact was assessed using the double materiality principle. The Integrated Annual Report prepared in accordance with GRI was preliminarily reviewed by the Management Board (Minutes No.13 of 10.05.2024) and approved on 31 May 2024 by the Board of Directors (Minutes No.07/24). |

| Conducting regular training and education for employees on anti-corruption policies and ethical standards to raise awareness and prevent corrupt practices | Trainings and educations for employees on anti-corruption policy and ethical norms were conducted |

Trainings have been conducted: 1. Anti-corruption measures in the quasi-public sector; 2. Introduction to Compliance. Anti-corruption legislation. Hotline. Conflict of Interest Management; 3. Code of Conduct as amended. Anti-corruption legislation. Hotline. Universal declaration; 4. Code of Conduct in the new edition. Anti-corruption legislation. Hotline; 5. Anti-Corruption Policy of Samruk-Energy JSC in a new version; 6. Requirements of anti-corruption legislation of the Republic of Kazakhstan, Anti-Corruption Policy of Samruk-Energy JSC, Code of Conduct of Samruk-Energy JSC; 7. Requirements of anti-corruption legislation of the Republic of Kazakhstan, Anti-Corruption Policy of Samruk-Energy JSC, Code of Conduct of Samruk-Energy JSC. |

|

| Improvement of ESG rating | An ESG rating was obtained with a score of 52, with an average of “3” | 30 December 2024 Report received from Sustainable Fitch Ltd, assigned an ESG rating with a score of 52, average “3”. | |

| Human capital development | Regular training programmes for managers on management skills, leadership, strategic planning and innovation, as well as best practices in management and operational management | During the reporting period, employees of the Company and subsidiaries and affiliates underwent training on the following topics: corporate training HR in ESG context, Diversity, Equality and Inclusion (DEI), strategic session Creating a culture of occupational safety and zero tolerance for workplace fatalities, Public speaking skills in difficult situations, Professionalism within the Company’s values, Effective negotiation skills, Public speaking, talent pool meeting with the EIS members on Leader in the new world, etc. | |

| Reducing staff turnover | Reduction of staff turnover, except for measures related to personnel optimisation | According to the 2HR report for 2024, staff turnover across the Group was 10% (target is no more than 14%). | |

| Ensuring social guarantees and social stability in the Company | Samruk Research Services conducted a survey of production personnel of Samruk-Energy JSC’s subsidiaries and affiliates and a survey of wellbeing of administrative and management personnel of Samruk-Energy JSC and its subsidiaries and affiliates |

The result of Samruk Research Services Company’s subsidiaries and affiliates production staff survey for the year 2024 was 69%. According to the results of the study of wellbeing of administrative and management personnel of Samruk-Energy JSC and its subsidiaries and affiliates, the well-being index was 46%. |

|

| Employment of persons with disabilities in jobs that do not require physical activity, e.g. dispatchers, call centre employees in subsidiaries and affiliates | Approved the Programme on creation and maintenance of favourable, inclusive and accessible environment for persons with disabilities in the Samruk-Energy JSC Group of companies by the decision of the Management Board of Samruk-Energy JSC dated 19 June 2024 | In 2024, 31 persons with disabilities (PWDs) were employed in the Group of companies of Samruk-Energy JSC, which is higher than the quota (22 PWDs) set by Samruk-Kazyna JSC. | |

| Approval of the Plan for the implementation of the Occupational Safety Management System Development Strategy of Samruk-Kazyna JSC for 2024–2028 | The Plan was developed and sent to subsidiaries and affiliates for implementation | Implementation of the Plan for the implementation of the Occupational Safety Management System Development Strategy of Samruk-Kazyna JSC for 2024–2028 is in progress. | |

| Preparation of an annual sustainability report in accordance with GRI | Integrated Annual Report prepared in accordance with GRI approved | The Integrated Annual Report prepared in accordance with GRI is preliminarily reviewed by the Management Board and approved on 31 May 2024 by the Board of Directors. | |

| Providing reports/information about the Company to creditors, financial institutions, rating agencies in accordance with their requests | Providing reports/information on the Company to creditors, financial institutions as required by the existing loan agreements, rating agencies as per their requests |

All reports and information about the Company to creditors, financial institutions in accordance with the requirements of the existing loan agreements are provided in due time. Information to the rating agencies was provided in due time and the rating was confirmed on 14 October 2024. |

|

| Reproduction of fishery resources | Stocking of reservoirs |

On 16 August 2024, AES Shulbinsk HPP LLP stocked the reservoir with 22,180 yearlings of carp. On 8 October 2024 AES Ust Kamenogorsk HPP LLP stocked the reservoir with 107,931 pieces of carp. |