Our Strategy

Kazatomprom is the largest global producer of natural uranium with priority access to one of the world’s largest uranium reserves.

Core business

- natural uranium mining

- making uranium products

- prospecting and exploration

- producing rare metals

The Company’s assets include the entire range of enterprises involved in the product chain – from prospecting and exploration, uranium mining, and nuclear fuel cycle products manufacture to science, social welfare and staff training.

The Company employs over 21,000 people. Kazatomprom is committed to sustainable development and international standards of corporate social responsibility. The Company's achievements have been recognised with international and national awards.

Kazatomprom is:

- The world's largest uranium producer: in excess of 20% of the world's uranium production.

- Owner of the largest uranium reserves with priority access to a high-quality resource base.

- Low-cost and easy-to-scale uranium mining by insitu recovery.

- Industry leader in operational efficiency, occupational health and safety as well as environmental protection.

- A leader in the development of strategies for the sustainable, long-term future of the uranium market.

In 2018, Kazatomprom adopted a new development strategy, focusing on five strategic goals for 2018-2028:

- Focus on the core business.

- Streamline mining, processing and sales volumes based on market conditions.

- Create value by enhancing marketing function and expanding sales channels.

- Introduce best-practice business processes.

- Develop industry leader corporate culture.

Strategy Implementation in 2023

| Strategic goals | Key results |

|---|---|

| Focus on the core business |

|

| Streamline mining, processing and sales volumes based on market conditions |

|

| Create value by enhancing marketing function and expanding sales channels |

|

| Introduce bestpractice business processes |

|

| Develop industry leader corporate culture |

|

Key risks of Strategy implementation

- The complex and non-quantifiable risks associated with the sanctions against Russia, including but not limited to possible imposition of sanctions against the State Atomic Energy Corporation Rosatom and its subsidiaries, as well as risks related to the current situation in Ukraine could undermine the Group's financial stability and trigger social tensions. There are also risks related but not limited to restrictions on mutual settlements in US dollars and other currencies, suspension of transshipment of goods through the territory of the Russian Federation, physical security of goods.

- The Group's profitability is directly linked to the uranium market price. The volatility of uranium prices may have a material adverse effect on the Group.

- Major accidents in the nuclear industry may lead to a decline in uranium prices.

- Nuclear energy competes with a number of other energy sources, and stable and lower prices for alternative energy sources could lead to a reduction in demand for nuclear feedstock, reductions in nuclear power development and nuclear power plant construction programs and, consequently, a reduction in demand for uranium and its market price.

- Nuclear energy is subject to public opinion risks, which could have a material adverse effect on the demand for nuclear energy and lead to increased regulation of the nuclear energy industry.

- The Group faces competition from other uranium suppliers and may lose end users of uranium products.

- The Group currently depends on a small number of customers who purchase a significant share of the Group's uranium, and any loss of important customers could have a material adverse effect.

- Some of the Group's customers and business partners may be subject to international sanctions and, if so, this might have a material adverse effect.

- The Group is a major taxpayer and thus exposed to tax risks, including changes in the uranium extraction tax rate and transfer pricing within the limitation period as the most significant risks.

- The Group's uranium mining and transportation operations are subject to operational risks, hazards, and unforeseen disruptions that could cause delays in the production and delivery of the Group's uranium and uranium products, increase the Group's production costs or lead to accidents on the Group's mining sites.

- The availability and cost of sulphuric acid significantly affect the continuity and commercial viability of the Group's operations, as the Group uses significant quantities of sulphuric acid to extract uranium.

- The Group may encounter difficulties in utilising railway lines connecting Kazakhstan with neighbouring countries or other transport infrastructure.

- The Group may see unfavourable outlooks regarding its current ore reserves or the discovery of new ore reserves; therefore, estimates or classifications of the Group's uranium ore reserves may be underestimated due to inherent uncertainties in the estimation of ore reserves.

- The Group is exposed to various financial risks related to compliance with certain financial and other restrictive covenants, fluctuations in interest rates and exchange rates, liquidity restrictions or inability to obtain necessary financing, and counterparty defaults.

- The Group may face arbitration or litigation to which it is not a party, and legal consequences of noncompliance/ misinterpretation of laws.

- The Group's insurance coverage may not be sufficient to cover losses arising from potential operational risks and unforeseen interruptions.

- Any failures of the Group's IT systems or cyberattacks could adversely affect results.

- Failure to meet targets for uranium (U3O8) production, output, sales, cost of products and services.

- Failure to improve corporate governance, safety and environmental performance.

- Failure to meet targets of fuel assembly production in the Republic of Kazakhstan.

- The Group is highly dependent on the macroeconomic, social and political conditions prevailing in Kazakhstan and may be subject to adverse sovereign action by local authorities or be subject to extensive government regulations and laws.

- The Group may be affected by labour unrest or rising social tension in Kazakhstan, which could have a material adverse effect on the Group's business and reputation.

- The Group's operations are subject to economic, political and legal developments in China, India, South-East Asia, Russia and other countries with increased risk of direct and secondary sanctions.

- Unexpected catastrophic events, including acts of vandalism and terrorism, could adversely affect the Group's business.

- Deterioration of the epidemiological situation in Kazakhstan and elsewhere may undermine the Group's financial stability, increased social tensions and inability to procure key operating materials.

In 2023, NAC Kazatomprom JSC implemented a number of important projects aimed at developing production capabilities and improving the environmental situation:

tonnes

Construction of a sulphuric acid plant with a production capacity of 800,000 tonnes per annum is underway in the village of Taikonur in Sozak District, Turkestan region. The project is expected to be completed in 2027.

Outcomes of the Initiative:

- Creation of jobs (150 people in construction, 500 people in operation).

- Annual tax deductions of about KZT 4 billion.

- Reducing dependence on sulphuric acid imports.

- Addressing the perceived shortage of sulphuric acid in Kazakhstan.

- Associated power generation of 30 MW.

- Socio-economic development of the region and SMEs.

- Introduction of new advanced technologies for sulphuric acid production in line with international environmental and energy saving standards.

- Retaining competitive advantage of the low-cost uranium industry in the world.

Construction and design timeframes:

2022-2027

Construction of uranium refinery with an annual capacity of 6,000 tonnes in line with global environmental and energy saving standards. Share in the project – 100%. Portfolio company – UMP JSC. Creation of jobs after commissioning of the plant.

Outcomes of the Initiative:

- Creation of jobs.

- Increase in tax deductions to the state budget.

- Increase of Kazakhstan's share in raw material processing in the global market.

- Increase of natural uranium production up to 6,000 tonnes per annum.

Construction and design timeframes:

2020-2026

Provision of existing tantalum, niobium and beryllium production facilities of Ulba Metallurgical Plant JSC with domestic mineral raw materials (Verkhniy Irgiz tantalum deposit, Karajal beryllium deposit) well as active search for other potential domestic deposits for further development to meet Ulba Metallurgical Plant’s production needs.

Outcomes of the Initiative:

- Reduction of production costs.

- Elimination of dependence on imported minerals.

- Creation of new jobs.

- Improvement of UMP JSC’s production efficiency.

Implementation timeframes:

2023-2029

The programme aims to improve the physical and mental health, financial as well as career and social well-being of employees. These actions are aimed at enhancing the general well-being of personnel, stimulating their productivity and creating a favourable atmosphere for the full development of their professional and personal potential for the benefit of both the employees and the Company.

Outcomes of the Initiative:

- Reduction of risks of social instability.

- Labour productivity increase.

- Increase of employees' welfare.

- Increase of employees' engagement and loyalty.

Implementation timeframes:

2023-2026

The Company's social project aimed at social and economic, infrastructural development, resolving social problems in the regions of the Company's presence as well as improving working conditions at the production facilities based on the submitted initiatives and suggestions from the Company's employees, subsidiaries and affiliates as well as local communities.

Outcomes of the Initiative:

- Reduction of risks of social tension.

- Forming a positive image among local communities in the regions.

- Employer brand development.

Implementation timeframes:

Annual.

The programme aims to develop talented leaders with the prospect of step-by-step career at NAC Kazatomprom JSC enterprises. The programme provides a 15-month paid internship in the Company and its subsidiaries and affiliates. Those entered the programme through a rigorous competitive selection undergo special training and gain a great deal of experience. Each young specialist has a mentor from among experienced employees.

Outcomes of the Initiative:

- Raising interest in the nuclear industry on the part of talented young people.

- Development of young specialists' potential.

- Career development of young specialists from among the employees of the Company and subsidiaries and affiliates.

- Enhancement of the level of employees’ involvement and loyalty.

Implementation timeframes:

Annual.

The programme aims at improving the employees’ health to ensure sustainable economic activity in the long term.

Kazatomprom implements the project through:

- Improvement of disease prevention and management.

- Formation of employees' commitment to a healthy lifestyle.

- Efficiency enhancement of available resources utilization.

Outcomes of the Initiative:

- Positive dynamics of key health indicators, reduction of sudden death rate due to health reasons.

- Involvement of personnel in disease prevention processes and formation of healthy lifestyle skills.

- Provision of safe food, medical care, and optimal microclimate conditions in shift camps.

- Methodological guidance and creation of a unified health protection policy.

Implementation timeframes:

2023-2027

The programme supports applicants, college graduates and elementary students from the Company operation regions. As part of the programme, participants can get a free educational grant for one-year study in Kazakhstan’s technical colleges and universities in priority technical specialties. If successful, past academic period, the the programme participants will be able to continue with the Murager Education Grant in the following academic year.

Outcomes of the Initiative:

- Popularisation of technical specialties among young people.

- Enhancement and strengthening of the local population trust and loyalty to the Company and its subsidiaries and affiliates.

- Improvement of Kazatomprom's sustainable development policy.

- Attraction of the young people’s attention to working professions, including technical and industrial training.

Implementation timeframes:

Annual.

In 2023, JV Budenovskoye LLP started pilot uranium mining at section 6, 7 of the Budenovskoye deposit.

Outcomes of the Initiative:

- Creation of jobs.

- Increase in tax revenues.

- Increase of socio-economic level of the region and SME development.

Reaching capacity timeframes:

2023-2026

Business Model

1 Includes unconsolidated entities – joint ventures and associates on a 100% basis, as well as liquidation funds and liquidation costs.

2 Includes expenses for employee professional development, training and retraining, knowledge retention and sharing within the Group.

Company's Asset Structure

14 mining assets operating in 26 deposits/blocks located in Kazakhstan, using the in-situ recovery (ISR) mining method, including:

Kazatomprom’s key assets in 2023

| Company | Asset description |

|---|---|

| Subsoil use | |

| Subsoil use contracts that grant the Group's subsidiaries mining rights in relation to 17 uranium deposits/blocks located in Shu- Sarysu and Syrdariya regions of Kazakhstan |

|

| Subsoil use contracts that grant Group's joint ventures and associates mining rights in relation to 9 uranium deposits/blocks in the Shu-Sarysu, Syrdariya, and North Kazakhstan regions |

|

| Production | |

| Ulba Metallurgical Plant JSC |

Productivity in 2023:

|

| Commerce | |

| Trade House KazakAtom TH AG. |

Uranium trading |

| Ancillary businesses | |

| SKZ-U LLP SSAP LLP |

680,000 tonnes of sulphuric acid – total annual production capacity |

| Volkovgeologia JSC |

Prospecting and drilling company |

| KAP Logistics (formerly known as Trade and Transport Company LLP) |

Transport and logistics company serving production assets |

| Qorgan-Security LLP |

Security services for Kazatomprom, its subsidiaries, and affiliates |

| KAP Technology LLP |

Ensures local and corporate telephone communications, data transmission, and VHF radio communications services to Kazatomprom’s entities |

| Uranenergo LLP |

Electricity transmission and distribution, operations of power grid and stations, reliable and uninterrupted power supply to uranium mining enterprises of Kazatomprom |

| Science, Engineering and Education | |

| Institute of High Technologies LLP |

Addresses strategic objectives in Kazakhstan’s nuclear sector to drive its innovative development, technological upgrade, palpable improvement in the quality and competitiveness of knowledgeintensive products, conducts R&D activities, works to introduce innovations in the sector, employees training and retraining |

Analysis of Performance Dynamics

PRODUCTION HIGHLIGHTS

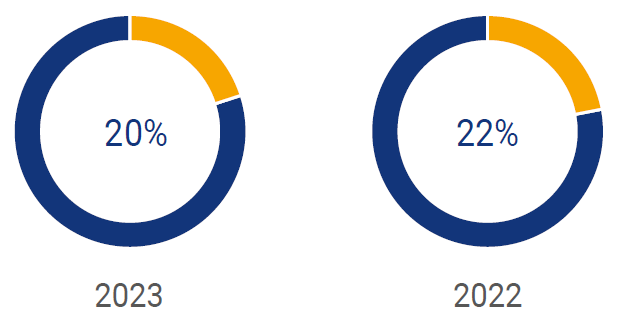

Kazatomprom is a national operator for the export and import of uranium and its compounds. This grants the Company certain privileges when granting subsoil use rights for uranium mining through direct negotiations. This ensures priority access to the high-quality natural uranium deposits in Kazakhstan using the in-situ recovery (ISR) mining method. In 2023, Kazatomprom confirmed its position as the world's leading uranium producer, accounting for about 20% of global production, with 39% of global uranium production coming from the Holding's mines in Kazakhstan.

Kazatomprom's share in the global natural uranium mining market (based on its attributable share of production), %

In 2023, Kazatomprom confirmed its leading position as the largest uranium producer, holding the largest share of the global market. According to UxC, the share of uranium produced by the Company in 2023 was approximately 20% of the global primary uranium production. At the same time, the share of uranium produced by Kazatomprom Holding companies in Kazakhstan reached approximately 39% of total global uranium production within the same period.

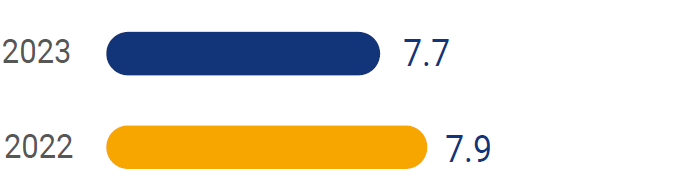

Kazatomprom's uranium output (attributable share of production), tonnes

Production in 2023 decreased due to a reduced production plan compared to 2022, as well as delays and limited access to materials and equipment. This impacted the well start-up schedule and overall ISR uranium production. Problems with access to key materials, such as sulphuric acid, may continue into 2024, impacting production volumes.

Niobium product output, tonnes of Nb

In 2023, niobium production decreased by 2.53% against 2022, in response to a change in demand for niobium products.

Beryllium product output, tonnes of Be

Compared to 2022, the output of beryllium products in volume terms decreased by 34.94% in the reporting period, in response to a decrease in demand for beryllium products.

Tantalum product output, tonnes of Ta

Compared to 2022, the output of tantalum products in volume terms increased by 7.38% in 2023 due to increased demand from customers.

Fuel pellet output, tonnes

The volume of fuel pellets production in 2023 amounted to 196.5 tonnes that is comparable to the production volume for 2022.

FINANCIAL HIGHLIGHTS

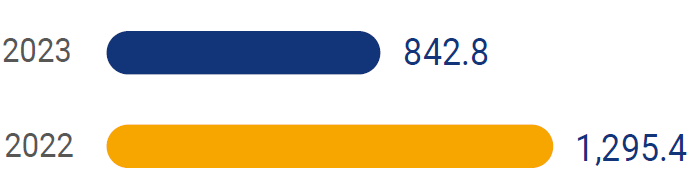

Group revenue, KZT billion

The Group's consolidated revenue was KZT 1,434,635 million in 2023, an increase of 43% against 2022. This growth is mainly attributable to:

- an increase in the average selling price due to an increase in the U3O8 spot price;

- an increase in U3O8 sales volume due to additional customer requests as well as new long-term contracts;

- an increase in revenues from the sale of EUP and other uranium products (including sales of pellets and tolling services) in accordance with the increase in the volume of FA deliveries by Ulba-FA LLP during 2023 and an increase in revenues from the sale of UMP rare metal products.

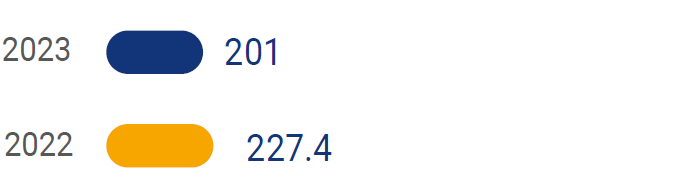

Dividends paid, KZT billion

In 2023, the Company declared dividends to its shareholders amounting to KZT 200,970 million and paid them in July 2023 based on 2022 performance (in 2022, the Company accrued dividends to its shareholders amounting to KZT 227,388 million, and paid them in July 2022 based on 2021 performance). There are no agreements in accordance with which dividends are not collected or a refusal to pay dividends is planned.

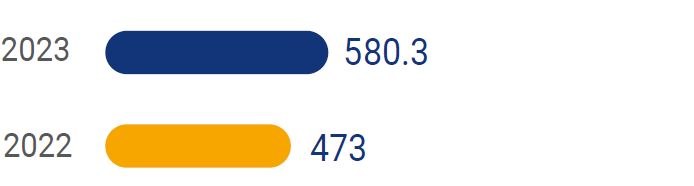

Net profit, KZT billion

Net profit in 2023 was KZT 580,335 million, an increase of 23% year-on-year (in 2022: KZT 472,963 million). Net profit percentage increase is in line with the growth in operating profit in 2023 as mentioned above.

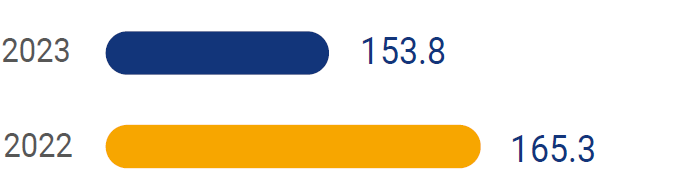

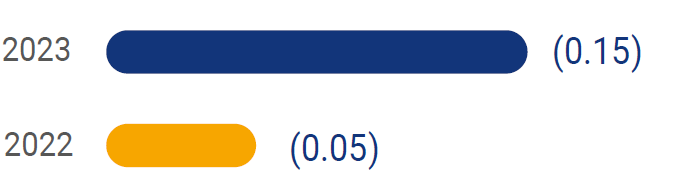

Net debt/adjusted EBITDA

The net debt to Adjusted EBITDA ratio increased by 0.1 against 2022. In 2023, adjusted EBITDA was KZT 828,623 million, an increase of 31% year-on-year (KZT 630,898 million in 2022), while EBITDA proportional to shareholding at the end of 2023 amounted to KZT 639,407 million, an increase of 29% year-on-year (KZT 495,357 million in 2022). The changes were mainly driven by higher operating profit at the consolidated level, as well as higher EBITDA at JVs and associates, which was mainly due to an increase in the average selling price associated with higher U3O8 spot price.

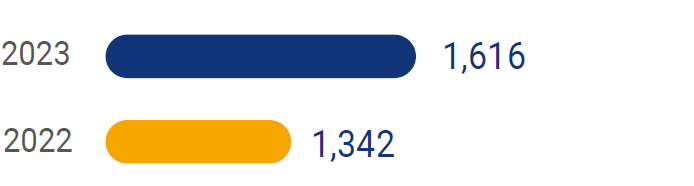

Earnings per share, KZT/share

Earnings per share in 2023 increased by 20% against 2022 and reached KZT 1,616.

Adjusted earnings per share, KZT/share

In 2023, adjusted earnings per share was KZT 2,237, emphasising the increase in adjusted net profit for the year excluding temporary effect affecting net earnings.

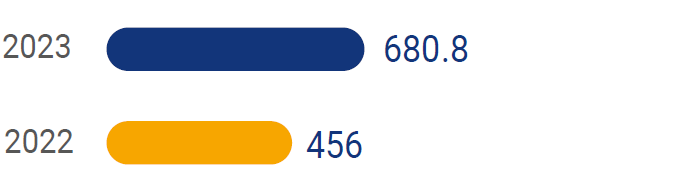

Operating profit, KZT billion

Operating profit in 2023 was KZT 680,812 million, an increase of 49% year-on-year (in 2022: KZT 455,962 million), mainly due to the increase in revenue in 2023 as mentioned above.

Uranium Products Market and Competitive Environment

GEOGRAPHY AND MARKET PRESENCE

Mineral assets

Company’s mineral assets are located in four key administrative districts of Kazakhstan, namely Kyzylorda, Turkestan, North Kazakhstan and Akmola Regions. This provides Kazatomprom with access to one of the world's largest uranium reserves.

Kazakhstan’s uranium provinces and distribution of uranium reserves based on the State Commission on Mineral Reserves standard3

3 State Commission on Mineral Reserves. Distribution of uranium reserves, percentage.

Highlights 2023

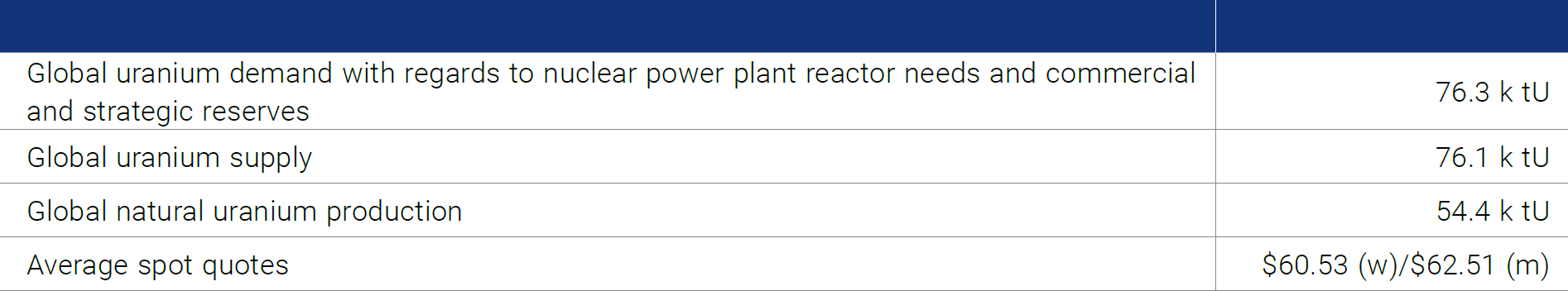

Significant developments in the global uranium market

|

Global geopolitical issues | The Russian nuclear industry has remained unaffected by sanctions, but sanctions sentiment among lawmakers in the UK, EU and US has led to some new initiatives and measures since the beginning of 2023, including the inclusion of some companies and senior executives from Russia's nuclear industry on the UK and US sanctions lists. |

|

EU | Government officials from 16 European countries, as part of the European Nuclear Alliance, which includes countries such as Belgium, France, Italy and the UK, aim to achieve 150 GW of nuclear power by 2050, significantly more than the current 100 GW. The alliance intends to achieve the target by building an additional 30-45 large reactors and small modular reactors (SMRs), thereby maintaining the current 25 per cent share of nuclear energy in EU electricity generation. |

|

UK | The UK's Department of Energy Security announced the launch of Great British Nuclear, a programme aimed at developing the construction of new nuclear power stations in the country, with funding that could reach up to GBP 20 billion (~USD 25.8 billion). |

|

France | France's Constitutional Council has approved a law aimed at speeding up the construction of new reactors by simplifying administrative procedures and planning. The law, approved by the parliament in May, removes France's previous cap on nuclear capacity and the requirement that nuclear power should account for only 50% of the national electricity mix by 2035. Nuclear power will thus account for more than 50 per cent of total electricity generation by 2050. |

|

Global Climate Strategy | The outlook for nuclear power continues to improve. At the UN climate change conference COP28, more than 20 countries signed a declaration to triple nuclear power capacity by 2050. The declaration recognises that nuclear power will play an important role in achieving zero emissions globally. Key aspects of the declaration also include intentions to call on international financial institutions to encourage the inclusion of nuclear power in energy infrastructure financing programmes. |

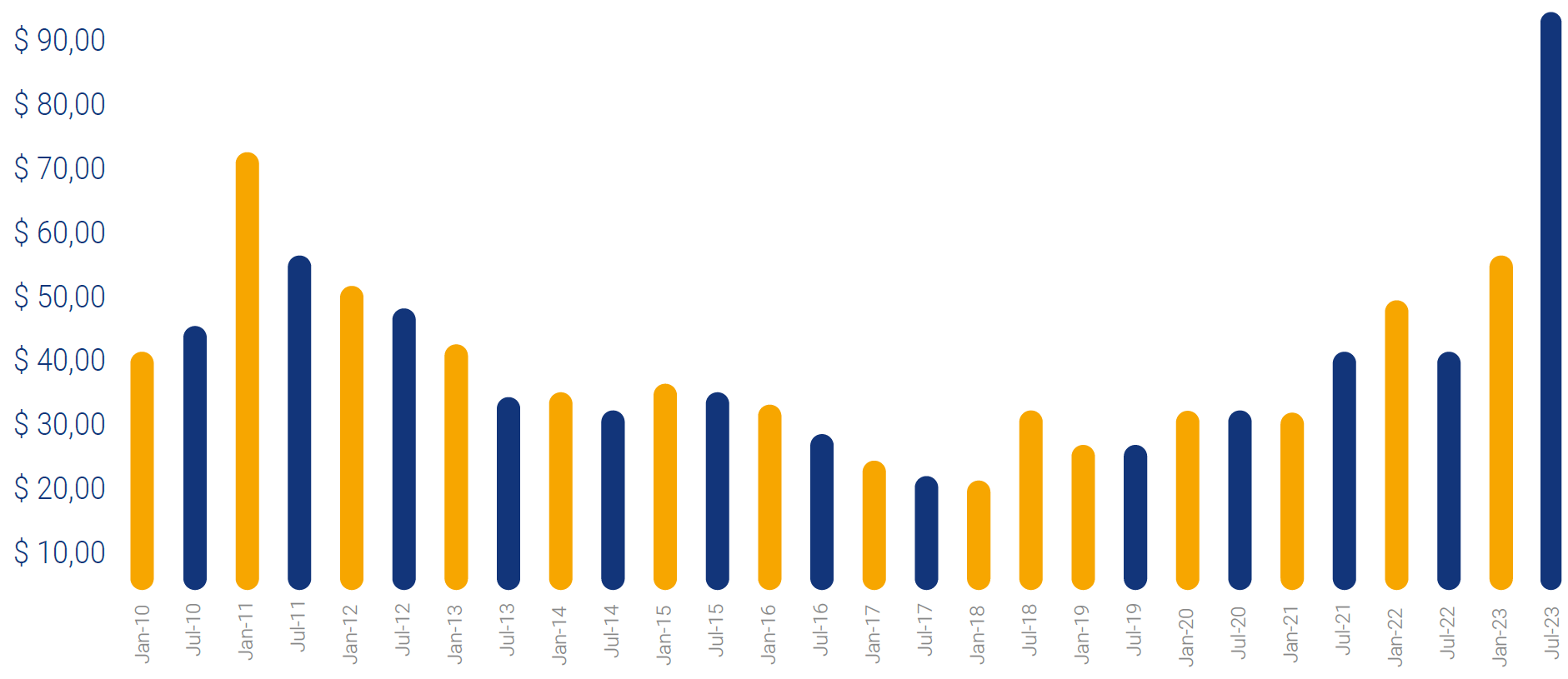

Pricing

Uranium prices, 2010-2023, USD per lb U3O84

4 Source: TradeTech, UxC.

Uranium output in 2023

Production volumes on a 100% basis and pro-rata ownership basis for 2023 were lower than those for 2022, primarily due to a slight decrease in the production plan for 2023 compared to 2022. This reflects the Company's disciplined approach to production and sales focused on creating long-term value.

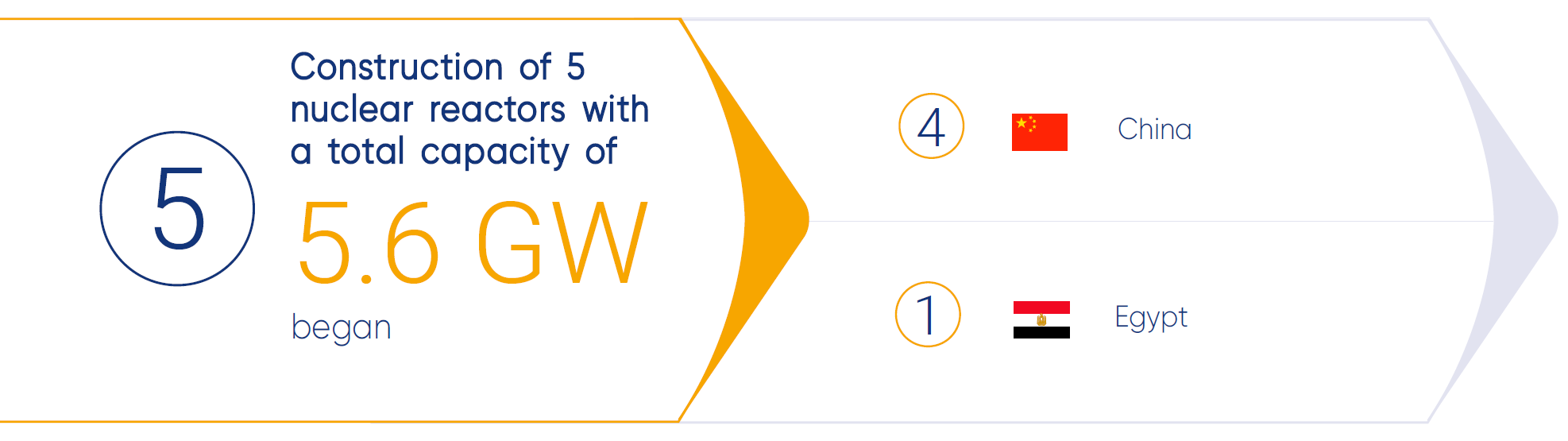

Reactors commissioning and decommissioning in 2023

Sales and Distribution

SALES OF URANIUM PRODUCTS

In 2023, the Company sold uranium products directly and through its subsidiary Trade House KazakAtom AG ("THK") to 23 customers in 9 countries (in 2022: 24 customers in 11 countries).

The table below provides data on the geographical distribution of the Group's sales:

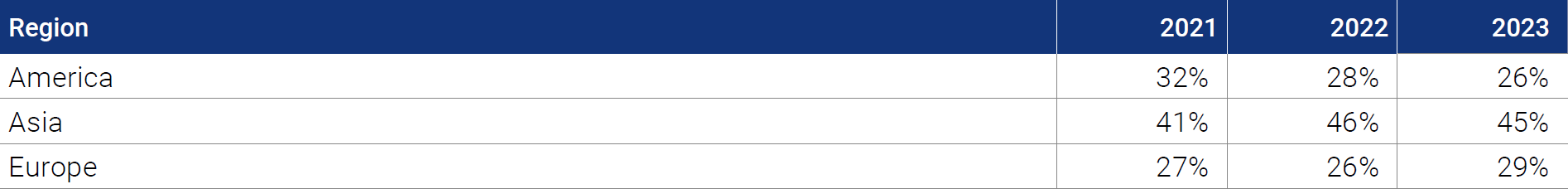

Consolidated sales* of Kazatomprom uranium products by region, %5

5 Source: Data by Kazatomprom.

* Include sales of uranium products to joint venture partners.

Including data on the geographical distribution of customers for the Company's uranium products:

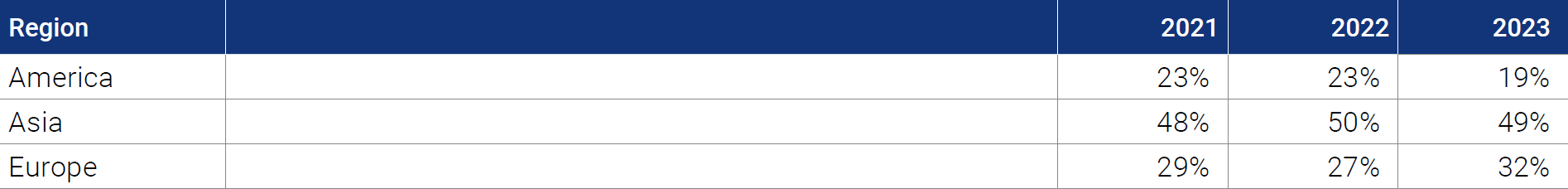

Sales of uranium products (U3O8) by the Company and THK by region6

(% of sales volume* U3O8)

6 Source: Company data, figures are rounded.

* The Company's sales volume (accounted for in the Group): includes total sales volumes to external buyers of the Company and THK. Intragroup transactions between the Company and THK are not considered.

Key achievements:

- Kazatomprom added 2 new clients to its portfolio;

- Kazatomprom expanded its sales geography by signing a contract to supply natural uranium to two new countries;

- sales volume increased;

- the level of contracting has increased.

TRANSPORTATION

Kazatomprom deploys safe, secure, and reliable logistics solutions to deliver uranium products to its customers across the globe. Uranium products are shipped by rail and/or sea in 20-foot containers. All shipments are insured against any risks associated with the uranium transportation.

In 2023, the Company made several physical deliveries via the Trans-Caspian International Transport Route (TITR) to final consignees in Romania, the USA and Canada. At the end of 2023, 64% of all uranium shipments from Kazakhstan to Western countries were successfully made through TITR.

In 2023, Kazatomprom delivered U3O8 and finished products to various destinations in accordance with customer needs and requirements:

Converters. The Group transported U3O8 to licensed conversion facilities owned by companies such as Honeywell (US), Cameco (Canada), and Orano (France), first by rail from the Company’s operations in Kazakhstan most commonly to the port of St. Petersburg in Russia, then by sea to various ports in the US, Canada or Europe. Afterwards, the supplies were moved by rail or road to processing facilities.

China. When transporting material to China, Company delivered its cargo to the Alashankou railway station.

Russia. When shipping to the Russian Federation, including to Siberian Chemical Combine JSC, the Company delivered its cargo by rail to Tomsk-2 Railway Station.

Romania. When delivering to Romania, the customer obtained title at the conversion plant in Feldior.

Argentina. When delivering to Argentina, the customer obtained title at the port of Buenos Aires. The average cost of shipping products to destinations shown on the map ranges from USD 0.7 to USD 6.6 per kilo of U3O8. The Group also enters into swap agreements to minimise delivery time and transportation cost and to reduce risks associated with the uranium products transportation.

Subsidiary

Company owns a 51% interest in the authorized capital of ME ORTALYK LLP (China National Nuclear Energy Group owns CGNM UK Limited 49%). The LLP operates at the central block of the Mynkuduk deposit and at the Zhalpak deposit in the Sozak District of Turkestan Region.

Deposit

The Mynkuduk deposit was discovered in 1973, and the commercial operation of the central block began in 2008. A subsoil use contract No.1796 to develop the Central Mynkuduk deposit block was concluded on 8 July 2005. The rights to the exploration, production and marketing of uranium are valid until 2033.

Pilot production was conducted at the Zhalpak deposit. The exploration contract No.4996 was concluded on 14 December 2021. The rights to the production and marketing of uranium are valid until 2042.

As of 1 January 2024, the total volume of ore reserves of the deposits (including annual depletion) was 33,500 tonnes. Total mineral resources (including reserves) stood at 33,500 tonnes.

Features

(Central Mynkuduk

production capacity – 2,000

t/year, Zhalpak – 900 t/year)

Turkestan Region,

Sozak District

2. Zhalpak

7 Erlan Lesbekovich Tashimov until 13 November 2023.

Subsidiary

Company is the only participant at RU-6 LLP.

In November 2018, the Company transferred to RU-6 LLP its rights and obligations under a subsoil use contract to develop the North Karamurun and South Karamurun deposits in the Shieli District of Kyzylorda Region.

Deposit

The North Karamurun and South Karamurun deposits were discovered in 1979, and commercial operation began in 1997.

A subsoil use contract to develop the North Karamurun and South Karamurun deposits was concluded on 27 November 1996. The rights to the exploration, production, and marketing of uranium are valid until 31 November 20408.

As of 1 January 2024, the total amount of ore reserves in the deposits (including annual depletion) was 11,900 tonnes of uranium. Total mineral resources (including reserves) stood at 11,900 tonnes of uranium.

Features

Kyzylorda Region,

Shieli District

2. South Karamurun

8 Decision of the Ministry of Energy of Kazakhstan according to Minutes No.1/5 of the meeting of the Subsoil Use Expert Commission dated 11 January 2023.

9 Iskakov Daurzhan Mukhamedzhanovich from 20 May 2021 to 26 October 2023.

Subsidiary

Company is the only participant at Kazatomprom-SaUran LLP.

In November 2018, the Company transferred to Kazatomprom- SaUran LLP its rights and obligations under subsoil use contracts for the Kanzhugan deposit, the south part of block No.1 (South) and the north part of block No.3 (Central) of the Moinkum deposit, the Vostochny block of the Mynkuduk deposit and the Uvanas deposit, together with related manufacturing assets.

Deposit

The Kanzhugan deposit was discovered in 1972; commercial operation began in 1997. A subsoil use contract to develop the Kanzhugan deposit was concluded on 27 November 1996. The rights to the exploration, production, and sale of uranium are valid until 31 December 204710.

The south part of block No.1 (South) of the Moinkum deposit was discovered in 1976, and the north part of block No.3 (Central) in 1974. Commercial operation of the southern part of block No.1 began in 1997, and the northern part of block No.3 in 2017.

A subsoil use contract for the south part of block No.1 (South) was concluded on 26 September 2000. The rights to the extraction, exploration, and sale of uranium are valid until 26 September 2021.

A subsoil use contract for the north part of block No.3 (Central) was concluded on 31 May 2010. The rights to the extraction, exploration, and sale of uranium are valid until 31 May 2041.

The Uvanas deposit was discovered in 1963, and commercial operation began in 1997. A subsoil use contract to develop the Uvanas block was concluded on 27 November 1996. The rights to the exploration, production, and sale of uranium to be valid until 15 November 2022.

The Mynkuduk deposit was discovered in 1973, and commercial operation of the Vostochny block began in 1997. A subsoil use contract to develop the Vostochny block of the Mynkudyk deposit was concluded on 27 November 1996. The rights to the exploration, production, and sale of uranium are valid until 31 December 202711.

Currently, uranium mining in the southern part of block No.1 (South) of the Moinkum deposit and the Uvanas deposit has been suspended due, to a depletion of reserves. Work is underway to return the territories to the state.

As of 1 January 2024, the total volume of ore reserves of deposits (including annual depletion) was 20,200 tonnes of uranium. Total mineral resources (including reserves) stood at 22,600 tonnes of uranium.

Features

Turkestan Region,

Sozak District

2. Moinkum, block No.1 (South),

the southern part

3. Moinkum, block No.3 (Central),

northern part

4. Uvanas

5. Mynkuduk, East block

10 Decision of the Ministry of Energy of Kazakhstan according to Minutes No.2/1 of the meeting of the Subsoil Use Expert Commission dated 13 January 2023.

11 Decision of the Ministry of Energy of Kazakhstan according to Minutes No.2/1 of the meeting of the Subsoil Use Expert Commission dated 13 January 2023.

12 Zhubanov Askar Aitzhanuly from 22 February 2023 to 26 October 2023.

Subsidiary

Company holds a 65% interest in the charter capital of APPAK LLP (Sumitomo Corporation holds 25%, Kansai Electric Power Co., Inc. holds 10%).

The joint venture operates in the Western block of the Mynkuduk deposit in the Sozak District of Turkestan Region.

Deposit

The Mynkuduk deposit was discovered in 1973, and commercial operation of the Zapadnoye block began in 2008.

A subsoil use contract was signed on 8 July 2005 to develop the Zapadnoye block of the Mynkuduk deposit. The rights to the exploration, production, and marketing of uranium are valid until 8 July 2035.

As of 1 January 2024, the total amount of ore reserves in the deposits (including annual depletion) was 14,300 tonnes of uranium. Total mineral resources (including reserves) stood at 18,500 tonnes of uranium.

Features

Turkestan Region,

Sozak District

13 Abdimoldaev Darkhan Kairatovich from 30 November 2021 to 29 May 2023.

Subsidiary

Company owns a 60% interest in the charter capital of JV Inkai LLP (Cameco holds 40%).

The joint venture operates at block No.1 of the Inkai deposit in the Sozak District of Turkestan Region.

Deposit

The Inkai deposit was discovered in 1976 and testing of block No.1 began in 2002.

A subsoil use contract was signed on 13 July 2000 to develop the Inkai deposit, block No.1. The rights to the exploration, production, and marketing of uranium are valid until 13 July 2045.

As of 1 January 2024, the total volume of ore reserves of deposits (including annual depletion) was 123,900 tonnes of uranium. Total mineral resources (including reserves) stood at 144,200 tonnes of uranium.

Features

Turkestan Region,

Sozak District

14 Pernesh Elnar Kairatuly until 21 February 2023, Zhylkaidarov Birzhan Sakenuly since 15 January 2024.

Subsidiary

Baiken-U LLP is owned 52.5% by the Company, with a direct share of 5% and 47.5% through Energy Asia (BVI) Limited.

The joint venture operates at the Khorasan-2 block of the North Khorasan deposit in the Zhanakorgan District of Kyzylorda Region.

The deposit is the deepest uranium deposit in Kazakhstan mined using the ISR method.

Deposit

The North Khorasan deposit was discovered in 1972, and commercial operation of the block began in 2010.

A subsoil use contract to develop the Khorasan-2 block of the North Khorasan deposit was concluded on 1 March 2006. The rights to the exploration, production, and marketing of uranium are valid until 1 March 2055.

As of 1 January 2024, the total volume of ore reserves of the deposits (including annual depletion) was 14,400 tonnes. Total mineral resources (including reserves) stood at 14,400 tonnes.

Features

Kyzylorda Region,

Zhanakorgan district

Joint venture

Company holds a 51% interest in the charter capital of Semizbay-U LLP (Chinese National Nuclear Power Group holds 49%).

The joint venture operates at the Irkol deposit in the Shieli District of Kyzylorda Region and at the Semizbay deposit in the Birzhan Sal district of Akmola Region.

Deposit

The Irkol deposit was discovered in 1976, and commercial operation began in 2008. A subsoil use contract to develop the Irkol deposit was concluded on 14 July 2005. The rights to the exploration, production, and marketing of uranium are valid until 4 March 2030.

The Semizbay deposit was discovered in 1973, commercial operation began in 2009. A subsoil use contract to develop the Semizbay deposit was concluded on 2 June 2006. The rights to the exploration, production, and sale of uranium are valid until 2 June 2031.

As of 1 January 2024, the total amount of ore reserves in the deposits (including annual depletion) was 8,800 tonnes of uranium. Total mineral resources (including reserves) stood at 19,800 tonnes of uranium.

Features

Kyzylorda Region, Shielinsky

District and Akmola Region,

Birzhan Sal district

2. Semizbay

15 Mailybaev Almas Abdillauly until 05 April 2023, Berdigulov Almat Kudaibergenovich from 06 April 2023 to 13 November 2023.

Joint operations

Company and Uranium One Netherlands B.V. (part of Rosatom Group) each hold a 50% interest in the charter capital of Karatau LLP.

The LLP operates at block No.2 of the Budenovskoye deposit in the Sozak District of Turkestan Region.

Deposit

The Budenovskoye deposit was discovered in 1979, and the commercial operation of block No.2 began in 2008.

A subsoil use contract was signed on 8 July 2005 to develop block No.2 of the Budenovskoye deposit. The rights to the exploration, production, and marketing of uranium are valid until 8 July 2040.

As of 1 January 2024, the total amount of ore reserves in the deposits (including annual depletion) was 33,500 tonnes of uranium. Total mineral resources (including reserves) stood at 129,900 tonnes of uranium.

Features

Turkestan Region,

Sozak District

block No.2

16 Kalibekov Saken Kazbekovich from 19 November 2021 to 13 November 2023.

Subsidiary

Company holds a 50% interest in the charter capital of JV Khorasan-U LLP (Uranium One Utrecht B.V. (part of Rosatom group) holds 30%, Energy Asia Holdings Ltd holds 20%).

The JV operates at the Khorasan-1 block of the North Khorasan deposit in the Zhanakorgan district of Kyzylorda Region.

Deposit

The North Khorasan deposit was discovered in 1972, and commercial operation of the Khorasan-1 block began in 2008.

A subsoil use contract to develop the Khorasan-1 block of the North Khorasan deposit was concluded on 8 July 2005. The rights to the exploration, production, and sale of uranium are valid until 8 July 2058.

As of 1 January 2024, the total amount of ore reserves in the deposits (including annual depletion) was 33,100 tonnes of uranium. Total mineral resources (including reserves) stood at 44,100 tonnes of uranium.

Features

Kyzylorda Region,

Zhanakorgan district

Khorasan-1 block

17 Umirbekov Adai Esirkepovich from 18 September 2020 to 13 November 2023.

Associate

Company and Uranium One Holland B.V. (part of the Rosatom group) each own 49.98% of the shares of JV ZARECHNOYE JSC, and Karabaltinsky Mining Plant JSC owns 0.04%.

The joint venture operates in the Zarechnoye deposit in the Otyrar district of Turkestan Region.

Deposit

The Zarechnoye deposit was discovered in 1977, and commercial operation of the deposit began in 2007.

A subsoil use contract to develop the Zarechnoye deposit was concluded on 23 September 2002. The rights to the exploration, production, and marketing of uranium are valid until 23 September 2025.

As of 1 January 2024, the total amount of ore reserves in the deposits (including annual depletion) was 3,300 tonnes of uranium. Total mineral resources (including reserves) stood at 3,900 tonnes of uranium.

Features

Turkestan Region,

Otyrar District

18 Bekbaev Zh.N. from 07 March 2023 to 02 February 2024, the duties of the General Director were assigned to deputies from 07 March 2023 to 01 February 2024.

Joint operations

Kazatomprom and Uranium One Group (Part of Rosatom Group) each hold a 50% interest in JV Akbastau JSC.

The JSC operates at blocks No.1, No.3 and No.4 of the Budenovskoye deposit in the Sozak District of Turkestan Region.

Deposit

The Budenovskoye deposit was discovered in 1976 and commercial operation of blocks No.1, No.3, and No.4 began in 2012.

Subsoil use contracts to develop blocks No.1, No.3 and No.4 of the Budenovskoye deposit were concluded on 20 November 2007. The rights to the exploration, production, and marketing of uranium in area No.1 are valid until 20 November 2037, and in blocks No.3 and No.4 until 20 November 2038.

As of 1 January 2024, the total volume of ore reserves of the deposits (including annual depletion) was 34,300 tonnes. Total mineral resources (including reserves) stood at 34,300 tonnes.

Features

Turkestan Region,

Sozak District

No.1, No.3, No.4

19 Zhunisov Arnur Zhumabekovich since 28 December 2023, Mailybaev Almas Abdillauly from 31 July 2023 to 28 December 2023.

Associate

Company holds a 49% interest in the charter capital of JV Katco LLP, and Orano (formerly known as AREVA) holds 51%.

The joint venture operates in the northern part of block No.1 (South) and at block No.2 (Tortkuduk) of the Moinkum deposit in the Sozak District of Turkestan Region.

Deposit

The Moinkum deposit was discovered in 1976, and the commercial operation of block No.1 began in 2001.

A subsoil use contract to develop the northern part of block No.1 (South) and block No.2 (Tortkuduk) of the Moinkum deposit was concluded on 3 March 2000. The rights to the exploration, production, and sale of uranium are valid until 4 March 2039.

As of 1 January 2024, the total volume of the ore reserves of deposits (including annual depletion) was 49,000 tonnes of uranium. Total mineral resources (including reserves) stood at 53,500 tonnes of uranium.

Features

Turkestan Region

(South), the northern part

2. Moinkum, block No.2

(Tortkuduk)

Associate

In the associated company JV Southern Mining and Chemical Company LLP, the Company has a 30% share, while the main share of 70% is owned by Uranium One Group JSC, which is part of the Rosatom group.

The joint venture operates at the Akdala deposit and at block No.3 of the Inkai deposit in the Sozak District of Turkestan Region.

Deposit

The Akdala deposit was discovered in 1982, and commercial operation began in 2004. A subsoil use contract to develop the Akdala deposit was concluded on 28 March 2001. The rights to the extraction, exploration, and sale of uranium are valid until 28 March 2026.

The Inkai deposit was discovered in 1976, and commercial operation of block No.4 began in 2007. A subsoil use contract was signed on 8 July 2005 to develop block No.4 of the Inkai deposit. The rights to the exploration, production and sale of uranium are valid until 8 July 2029.

As of 1 January 2024, the total amount of ore reserves in the deposits (including annual depletion) was 72,700 tonnes of uranium. Total mineral resources (including reserves) stood at 74,900 tonnes of uranium.

Features

Turkestan Region,

Sozak District

2. Inkai, block No.4

20 Umirbekov Adai Yesirkepovich since 13 November 2023.

Joint venture

Company holds a 51% interest in the charter capital of JV Budenovskoye LLP (Limited Liability Partnership Stepnogorsk Mining and Chemical Plant holds 49%21.

The joint venture operates at blocks No.6 and No.7 of the Budenovskoye deposit in the Sozak District of Turkestan Region. A subsoil use contract for the development of Blocks 6 and 7 of Budenovskoye deposit was made on 16 October 2020. Uranium production and marketing rights are valid until 16 October 2045.

Deposit

The Budenovskoye deposit was discovered in 1976, and pilot production began in 2023 at site No.6 and 7.

As of 1 January 2024, the total amount of ore reserves in the deposits (including the increase in balance reserves) was 114,000 tonnes of uranium. Total mineral resources (including reserves) stood at 119,900 tonnes of uranium.

Features

Turkestan Region,

Sozak District

No.6, 7

21 As part of the audited financial statements of JV Budenovskoye LLP based on the results of 2022, information was received from JV Budenovskoye LLP on a change in the composition of the participants of Stepnogorsk Mining and Chemical Plant LLP, which includes Uranium One Group JSC and NFC Logistics JSC.

22 Medeo Rustam Kolybekovich until 24 March 2023, Zhansugurov Dauren Orashovich since 29 December 2023.